AML Fines and penalties are an essential part of money laundering regulations for financial institutions (FI). Without them, there will be all kinds of financial crimes such as fraud, and money laundering, mismanagement of funds leading to several consequences such as financial losses.

Money laundering is a big menace when it comes to the global financial system and this involves criminals using numerous ways to bring their illegal monies into the financial system. AML penalties and AML fines help to eliminate these menance to ensure transparency in the financial system. Financial regulatory bodies in different countries such as Fincen in the United States are in the position of penalizing any FI that violates the AML rules and regulations.

This article discusses some top recent AML fines and penalties of 2024 so far, including the td bank settlement in the most interesting way for your understanding.

Ready? Let's dive in!

Why Is Anti-Money Laundering Regulations So Important in Preventing Anti-Money Laundering Fines?

Anti-Money Laundering (AML) regulations are a critical component of the global financial system, designed to prevent illicit activities such as money laundering, terrorist financing, and other criminal endeavours.

These regulations impose obligations on financial institutions to identify, report, and prevent suspicious transactions that may be linked to criminal activities.

In recent years, there has been a significant increase in the frequency and severity of anti money laundering fines and penalties imposed on financial institutions for AML violations. Regulatory bodies worldwide are stepping up their enforcement efforts, recognizing the devastating consequences of money laundering and its potential to undermine the stability of the financial system. Failure to comply with AML regulations can result in substantial financial penalties, reputational damage, and even criminal prosecution.

What Are The Key Global AML Regulators Affecting Top AML Fines And Penalties Of 2024 So Far?

When looking for the recent anti-money laundering fines of 2024 so far, one has to first find out what regulatory agencies are responsible for upholding optimal AML practices and doling out these penalties. We categorise them into the following:

- Global regulators

- Regional regulators and

- National regulators

1. Global Regulators

There are some notable AML regulators in the world, but none gets more recognition in the global sphere than the Financial Action Task Force (FATF).

i. Financial Action Task Force (FATF)

The Financial Action Task Force (FATF) is an inter-governmental body that sets international standards to combat money laundering and terrorist financing. It works with the governments of 40 countries worldwide, 9 regional associate members and about 26 observers made up of financial institutions and international law enforcement agencies. The FATF seeks to develop and promote effective measures to prevent these illicit activities.

ii. Regional Regulators

Some of the most popular regional AML regulators include:

iii. European Central Bank (ECB)

This bank oversees the financial stability of the Euro area. It also enforces AML/CFT regulations for banks and other financial institutions within its jurisdiction; imposing fines on institutions that fail to comply with AML/CFT requirements.

One of their most recent activities happened in April, where the European Central Bank (ECB) announced the first group of financial institutions selected to participate in its initial trials aimed at exploring new technologies for settling wholesale transactions in central bank money.

iv. Financial Conduct Authority (FCA)

This is the United Kingdom’s top financial regulator. It enforces AML/CFT regulations for a wide range of financial firms in the UK, including banks, insurance and cryptocurrency. It imposes significant fines on banks and other financial institutions for AML/CFT breaches in the UK.

One of their most recent anti money laundering fines includes the issuance of a strong warning to CEOs of Annex 1 firms, highlighting major lapses found in recent assessments of compliance with money laundering regulations.

v. Federal Reserve:

This is the central bank of the United States of America, it also enforces AML/CFT regulations for banks and other financial institutions operating in the US and its territories. It also takes enforcement actions against institutions for violations of AML/CFT laws.

One of the recent AML cases prosecuted by the Federal reserve includes the Federal Reserve Board fining Silvergate Capital Corporation and Silvergate Bank $43 million for failing to properly monitor transactions in line with anti-money laundering laws.

These regional regulatory agencies are responsible for effecting top AML fines and penalties of 2024 so far in their respective regions.

2. Popular National AML Regulators

Among some of the world most known national AML regulators are the

i. U.S. Department of Justice:

The U.S. Department of Justice is the primary law enforcement agency in the United States. It investigates and prosecutes money laundering and other financial crimes. The department is known to have brought numerous cases against financial institutions and individuals for AML/CFT violations. One of their most recent convictions happened in June 2024 involving Mukhiddin Kadirov in a conspiracy to launder millions of dollars from a health care fraud scheme primarily targeting the Medicare and Medicaid programs.

ii. UK's Serious Fraud Office:

The UK's Serious Fraud Office is the national crime agency for fraud and corruption in the United Kingdom. It is responsible for investigating and prosecuting complex fraud cases, including money laundering. The office has brought several high-profile cases against financial institutions and individuals. One of the most recent being the conviction of former investment manager David Kennedy for his involvement in a £100 million investment fraud in which hundreds of people lost their savings.

In conclusion, both regional and national regulators are playing a crucial role in combating money laundering and terrorist financing. Their enforcement actions, combined with the guidance and standards set by the FATF, are helping to strengthen the global financial system and protect against illicit activities.

Interesting Read :Understanding the Relationship Between Corruption and AML

AML Enforcement Actions Of 2024

Some of the world’s top enforcement actions come through the Financial Action Task Force (FATF). Through these enforcement actions, the task force identifies countries with weak anti-money laundering and counter-financing of terrorism (AML/CFT) measures. This is done through two public documents released three times a year.

These lists, often referred to as the "black" and "grey" lists, highlight jurisdictions with significant deficiencies. Since the FATF began this process, it has reviewed 133 countries, publicly identifying 108 with weak AML/CFT regimes. Of these, 84 have since made reforms to strengthen their systems and have been removed from the list.

Let us take a look at these lists below:

1. The FATF 2024 Black List

As of June 2024, the FATF "black list," formally known as High-Risk Jurisdictions subject to a Call for Action, includes countries with severe strategic deficiencies. FATF calls on its members to apply enhanced due diligence to these nations, and in extreme cases, countries may face countermeasures to protect the international financial system from risks linked to money laundering, terrorist financing, or proliferation financing. As of June 2024, North Korea, Iran, and Myanmar are on the blacklist.

2. The FATF 2024 Grey List

The "grey list," or Jurisdictions under Increased Monitoring, comprises countries working with the FATF to improve their AML/CFT regimes. These jurisdictions have committed to addressing their deficiencies within agreed timeframes. As of June 2024, the grey list includes countries such as Bulgaria, Kenya, South Africa, Vietnam, and several others.

Recommended:

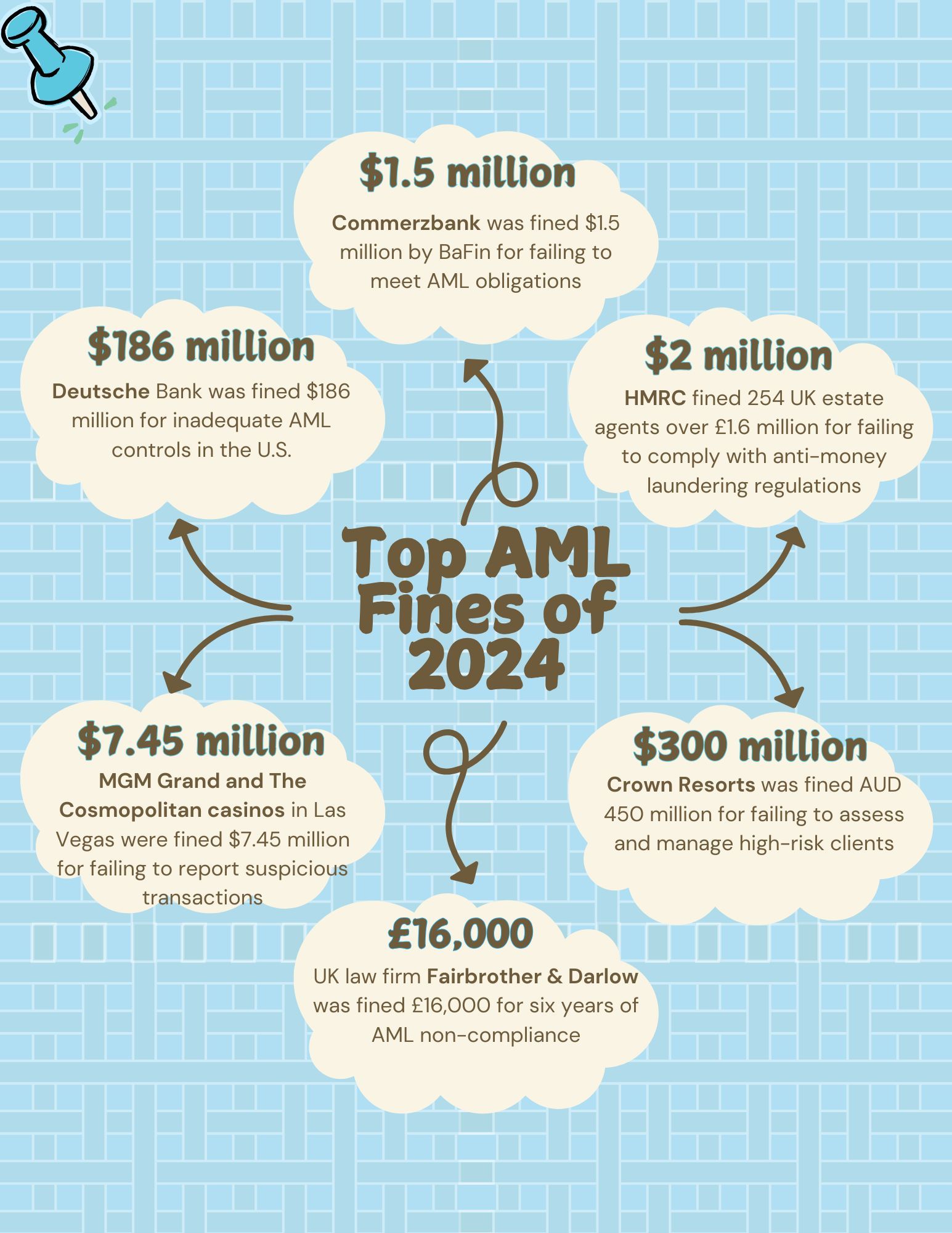

Top 6 AML Fines And Penalties Of 2024 So Far

In 2024, recent anti money laundering fines surged across various sectors, with financial institutions, real estate agencies, law firms, and casinos facing significant AML penalties. The reasons for these fines range from insufficient due diligence on business partners to a complete failure to uphold AML responsibilities.

This trend highlights a growing focus on holding organisations accountable for not doing enough to prevent money laundering. Below, in no particular order, are some of the largest AML fines and penalties issued this year.

1. Commerzbank - $1.5 million

Germany’s financial regulator BaFin fined Commerzbank $1.5 million for failing to meet AML obligations. Commerzbank and its former subsidiary comdirect Bank AG were cited for poor supervision, particularly in updating customer data and maintaining data security and made it to the list of AML compliance fines of the year 2024. The bank's inability to address these deficiencies highlights that even large financial players must continuously strengthen their AML controls.

2. Deutsche Bank - $186 million

Deutsche Bank was fined $186 million for inadequate AML controls in the U.S. The AML penalty stemmed from the bank's failure to address warnings from regulators about their compliance deficiencies. This hefty fine underscores the consequences of not resolving recognized compliance issues, even for globally established financial institutions.

3. Estate Agents - $2 million

In the UK, HMRC fined 254 estate agents over £1.6 million for failing to register or re-register for AML compliance. Penalties ranged from £1,500 to over £50,000, highlighting widespread breaches of Money Laundering Regulations. Many of these businesses either deliberately ignored or were unaware of the need to register with HMRC. Additional violations included inadequate customer due diligence (CDD) and poor documentation practices.

4. MGM Grand & The Cosmopolitan - $7.5 million

Two major Las Vegas casinos, MGM Grand and The Cosmopolitan, were given an AML compliance fine of $7.45 million for AML violations linked to an illegal sports betting operation. The U.S. Attorney’s Office found that the casinos failed to comply with the Bank Secrecy Act by not reporting suspicious transactions. Former MGM Grand President Scott Sibella admitted to ignoring these responsibilities, allowing Wayne Nix, who ran the illegal betting ring, to gamble without proper Source of Funds (SOF) checks, potentially facilitating money laundering.

5. Crown Resorts - $300 million

Australian casino operator Crown Resorts was given one of the redefining AML criminal penalties of the year that shook them to the bone. They were fined AUD 450 million ($300 million) for failing to assess and manage high-risk clients. The severe penalty exposed significant AML failures in monitoring high-rolling customers, damaging the reputation of the casino industry. This case underscores the ongoing challenges within the gambling sector and the need for stricter compliance measures.

6. Fairbrother & Darlow - $20,000

UK law firm Fairbrother & Darlow received a £16,000 fine from the Solicitors Regulation Authority (SRA) for six years of AML non-compliance. The firm failed to conduct a comprehensive risk assessment and implement policies required under the 2017 Money Laundering Regulations. Although they declared compliance in 2020, they only met the standards by 2023, leading to this penalty despite their cooperation and remedial actions.

7. Ted Bank Fined 1.3 billion dollars Penalty by Fincen- The TD Bank Settlement

The U.S. Treasury Department's FinCEN imposed a record $1.3 billion penalty on TD Bank for violating the anti-money laundering laws.

The TD Bank settlement refers to agreements between TD Bank and various U.S. authorities in October 2024 to resolve investigations into money laundering and Bank Secrecy Act (BSA) violations. Here's a breakdown of the key aspects:

Plea of Guilty: TD Bank pleaded guilty to a felony conspiracy charge to commit money laundering, making it the first bank in U.S. history to do so.

This td bank aml fine is the largest penalty ever against a U.S. bank. FinCEN found that TD Bank's AML program was inadequate, allowing billions of dollars in potentially illicit transactions to go unchecked. This included facilitating narcotics trafficking, human trafficking, and terrorist financing.

TD Bank willfully ignored numerous red flags, including suspicious activity involving its own employees and large cash transactions linked to criminal activity. The bank also failed to file thousands of required reports, hindering law enforcement investigations. As part of the settlement, TD Bank will undergo a four-year independent monitorship to overhaul its AML program and address systemic deficiencies. This includes a comprehensive review of its transaction data to identify and file previously missed suspicious activity reports.

The Biggest 6 AML Fines In History

Now that we have checked out some of the top AML fines of 2020, let us now take a quick detour to check out the biggest penalties for AML violations in recorded history.

1. BNP Paribas - $9 billion

In 2014, French bank BNP Paribas was fined $9 billion by U.S. regulators for violating U.S. sanctions against Sudan, Iran, and Cuba. The fine was the largest ever imposed on a foreign bank at that time. Also one of the biggest of the BSA fines and penalties, this move marked a significant milestone in the enforcement of sanctions laws.

They were accused by the US Department of Justice of processing thousands of transactions involving entities from these sanctioned countries, despite knowing that such activities were prohibited. BNP Paribas's actions were seen as posing a threat to national security and undermining U.S. foreign policy objectives.

2. Binance - $4.3 billion

Last year, cryptocurrency giant Binance, who happened to be the world's largest cryptocurrency exchange at that time, were fined $4.3 billion by the U.S. Department of Justice for violating anti-money laundering and sanctions laws.

Binance was accused of failing to implement adequate AML controls, allowing individuals and entities to use the platform for illicit activities, including drug trafficking and sanctions evasion. They were also criticised for not conducting sufficient due diligence on its customers and for not reporting suspicious activity to authorities. Many believe that the binance BSA AML penalty will bring untold scrutiny on the cryptocurrency world.

3. UBS - $4.2 billion

In 2018, Swiss bank UBS was fined $4.2 billion by U.S. regulators for manipulating benchmark interest rates. The bank was accused of colluding with other major banks to rig the London Interbank Offered Rate (LIBOR), a key benchmark used to set interest rates on trillions of dollars of financial products.

The fine was also the largest ever imposed on a foreign bank at the time for BSA AML violations; especially one on interest rate manipulation. The fine further highlighted the systemic risks posed by such misconduct. UBS was forced to plead guilty to criminal charges and to implement significant reforms to its compliance program.

4. Danske Bank - $2.2 billion

Danish bank Danske Bank was fined $2.2 billion by authorities in Denmark, the United States, and Estonia, in 2020, for its involvement in a massive money laundering scheme. The scandal involved billions of dollars being laundered through a non-resident Estonian branch of the bank.

Danske Bank was accused of failing to adequately monitor and report suspicious activity, and of turning a blind eye to the illicit nature of the transactions. The fine was the largest ever imposed on a Danish bank and resulted in significant reputational damage and legal consequences.

5. HSBC - $1.9 billion

In 2012, HSBC, a global banking giant, was fined $1.9 billion by U.S. regulators for failing to detect and report money laundering activities. The bank was accused of allowing billions of dollars to flow through its accounts, despite evidence suggesting that the funds were linked to drug cartels, terrorist organisations, and other criminal activities. This is one of the various BSA AML penalties that have shaken the US and global financial sphere. Experts confirm that the fine was a result of a multi-year investigation by U.S. authorities, which uncovered serious deficiencies in HSBC's anti-money laundering controls.

6. Deutsche Bank - $630 million

In 2017, German bank Deutsche Bank was fined $630 million by U.S. regulators for violating U.S. sanctions against Iran and Sudan. The bank was accused of processing thousands of transactions involving entities from these sanctioned countries, despite knowing that such activities were prohibited.

The fine was a significant blow to Deutsche Bank's reputation and resulted in increased scrutiny from regulators worldwide. The bank was forced to implement stricter compliance measures to prevent future violations and to pay a significant price for its failure to adhere to sanctions laws.

These are just a few examples of the largest AML fines ever imposed. It's important to note that fines can vary significantly depending on the severity of the violations and the jurisdiction involved.

What Is The Impact of Fines and Penalties on the Financial Industry?

Financial institutions that face significant fines and penalties for AML violations can experience a range of negative consequences including:

1. Increased Operational Costs

Defending against regulatory investigations and legal proceedings can be extremely costly, running up to hundreds of thousands of dollars - if not millions in legal fees. In addition to this, these affected organisations may need to invest heavily in upgrading their AML compliance programs to prevent future violations. Furthermore, rebuilding a damaged reputation can require significant marketing and public relations efforts.

2. Damage to Reputation and Brand

This can cause customers, investors, and business partners to lose trust in the institution, leading to decreased business and potential boycotts. Also, the fines and penalties can bring negative media coverage, which can tarnish the institution's image and make it difficult to attract new customers or retain existing ones.

These fines and penalties cause increased regulatory scrutiny and can lead to additional costs and burdens.

3. Regulatory Scrutiny and Potential Restrictions

This brings stricter oversight or restrictions on the institution's operations, limiting its ability to conduct certain activities. In some cases, regulators may require institutions to enter into consent orders, which can impose specific requirements or restrictions. In severe cases, individuals and institutions may face criminal prosecution, leading to significant legal and reputational consequences.

How Do Financial Institutions' Respond To Increased Regulatory Pressure?

When faced with increased regulatory pressure, financial institutions can mitigate the risks associated with AML violations, by taking a number of steps to enhance their compliance programs. This includes:

1. Enhanced AML Compliance Programs

This involves conducting regular risk assessments to identify potential vulnerabilities and areas of concern. Implementing robust customer due diligence procedures to verify the identity of customers and assess their risk profile is also another thing to do. Organisations must also use advanced technology to monitor transactions for suspicious activity and provide ongoing training to employees on AML regulations and best practices.

2. Investments in Technology and Data Analytics

Financial institutions must invest in specialised AML software to automate compliance processes and improve efficiency. They must also use data analytics to identify patterns and trends that may indicate suspicious activity. Leveraging AI also comes in handy to enhance AML capabilities, such as customer profiling and transaction monitoring.

3. Changes in Corporate Governance

Financial organisations also have to enforce a change in their corporate governance by strengthening board oversight of AML compliance to a top priority.

They also have to establish independent compliance functions to provide objective oversight and reporting. Accountability is also key, holding individuals at the helms of affairs for AML compliance failures, including senior executives.

By taking these steps, financial institutions can reduce their risk of AML violations and avoid costly fines and penalties. However, the regulatory landscape is constantly evolving, and institutions must remain vigilant and adapt to new challenges.

Conclusion

Now that we have checked out some of the top AML fines and penalties 2024, we can say that in 2024, regulatory bodies have maintained a strong focus on AML enforcement, imposing significant penalties on non-compliant institutions.

As financial services increasingly adopt advanced technologies, new AML regulations will likely emerge to address the associated risks. Cross-border collaboration among regulators will continue to combat international money laundering and terrorist financing.

Key trends include the growing use of data analytics to investigate complex schemes, the need for updated AML frameworks to address cryptocurrencies and blockchain, and the rising importance of cybersecurity in preventing money laundering.

To avoid penalties and mitigate risks, financial institutions must prioritise robust AML compliance programs. These should include regular risk assessments, thorough customer due diligence, advanced transaction monitoring systems, and ongoing employee training. Investments in technology, such as data analytics and AI, are crucial for enhancing AML capabilities, while strong governance ensures compliance remains a top priority. By implementing these measures, institutions can safeguard their reputation and contribute to a more secure financial environment.

To ensure that your financial institution stays on the right path of anti-money laundering compliance, you need Youverify’s compliance solutions. All you need to enjoy the best regulatory compliance solutions, tailored to suit your needs is to book a demo today. Kick back and relax and watch us keep your organisation on the right side of the law.