Regulatory bodies are essential in ensuring compliance and maintaining ethical standards across industries in today's complicated and ever-changing commercial landscape. Non-compliance with these regulations can result in severe financial penalties, reputational harm, and even legal ramifications. The purpose of this article is to serve as a comprehensive analysis to shed light on the importance of regulatory bodies and the potential impact of compliance fines on enterprises. Businesses may effectively control and mitigate risks by proactively navigating regulatory frameworks and establishing robust compliance strategies by knowing these crucial components.

Why Are Regulatory Bodies Important?

Regulatory Bodies are level players; they are important in keeping the ecosystems of industries fair and stable. Regulatory bodies are either government or nongovernmental organisations that are responsible for overseeing and regulating the financial sector. They play a crucial role in ensuring that the finance and fintech industry is stable and secure for consumers and employees as well as businesses, as well as ensuring the prevalence of fair practices.

A primary objective or aim of regulatory bodies is to protect consumers, maintain market integrity, and foster innovation by mitigating risks associated with the financial and commercial activities in the industry. Examples of regulatory bodies in Fintech include; the Financial Conduct Authority of the UK, the Consumer Financial Protection Bureau, the Security Exchange Commission of the UK, the European Banking Authority, the Monetary Authority of Singapore, the Australian Securities and Investments Commission (ASIC), etcetera. These are the only notable regulatory bodies from different countries and continents that may operate across borders.

The following reasons are why regulatory bodies are important:

1. Protection of Consumers

Regulatory bodies are vital in safeguarding consumers' interests and rights in the financial industry, as they establish rules and regulations to guarantee fair practices, transparency, and the provision of accurate information, which safeguards consumers from fraudulent activities, illicit practices, and illicit conduct.

2. Ensuring Market Stability

They play a crucial role in maintaining the stability and integrity of the financial markets. As oversight bodies, they oversee and monitor the activities of financial institutions, such as banks, investment firms, and fintech companies, to prevent market manipulation, fraud, and excessive risk-taking. Regulatory bodies ensure that markets operate in a fair and orderly manner, minimising systemic risks and promoting investor confidence.

3. Ensuring Compliance and Ethical Standards

Regulatory bodies set and enforce compliance standards as well as ethical guidelines for the financial industry. They establish frameworks and codes of conduct that organisations must adhere to promote responsible and ethical behaviour. By enforcing these standards, these regulatory bodies can help prevent money laundering, corruption, and other illegal activities that can have negative impacts on the specific industry and society at large.

4 Maintaining Innovation and Competition

Regulatory authorities attempt to strike a balance between promoting innovation and protecting consumers. They foster an environment that benefits technological developments and competition in the financial business. They assist startups and existing businesses in developing new products and services while remaining in regulatory compliance by offering regulatory clarity and direction.

5. Risk Mitigation

Risks linked with financial activity are assessed and mitigated by regulatory agencies. They undertake routine inspections, audits, and examinations to uncover potential system risks and weaknesses. They can maintain the financial system's stability by monitoring and overseeing financial institutions and intervening early to prevent hazards from rising.

6. Maintaining Confidence and Trust

Regulatory agencies play a critical role in establishing and sustaining confidence in the financial industry. Their oversight and enforcement measures guarantee that firms operate in a transparent and responsible manner, protecting consumers, investors, and other stakeholders' interests. This, in turn, develops industry trust and adds to its sustainability over the long term.

7. Systematic Risk Management

Regulatory bodies or oversight bodies monitor and manage systemic risks that have disastrous effects on the general economy. They develop policies to avoid the accumulation of excessive risk in the financial system, such as capital adequacy requirements for banks and stress tests to measure their resilience. Regulatory agencies contribute to the overall financial system's stability by limiting systemic risks.

8. International Coordination

In order to tackle cross-border challenges and unify regulatory frameworks, regulatory authorities frequently coordinate and cooperate with their colleagues in other countries. This collaboration aids in the fight against global financial crime, the sharing of best practices, and the establishment of common regulatory standards across nations. It also makes international corporate activities easier and increases trust in the global financial system.

Impact of Compliance Fines On Organisations

Compliance fines have become an important and popular way to impose sanctions on commercial entities, especially on big multinational corporations. Its expenses accrued may serve as a way to compel companies to comply with the compliance rules and regulations put in place. The prospect of facing substantial financial penalties motivates companies to take compliance seriously and implement measures to prevent violations. Fines can serve as a source of caution to commercial entities.

The potential financial burden of fines prompts companies to rather invest in robust compliance programs and to take proactive steps to prevent violations of regulations. Compliance is no longer viewed as an ethical obligation but as a strategy to mitigate costs. Therefore fines foster a culture of compliance within commercial industries, making it become part of their operations. Compliance fines are not just punishments but level players.

The following are the impacts of fines on commercial entities:

i. Legal Consequences

Compliance fines can lead to legal consequences for organisations. Aside from fines, oversight bodies may initiate legal proceedings or investigations that can result in further legal expenses, litigations, and penalties. Firms may also face legal suits from affected customers, employees, as well as shareholders, seeking compensation for the damages caused by them arising from non-compliance. Legal proceedings consume significant time, resources, and management attention, diverting focus from core business operations.

ii. Internal Disruption

Fines for non-compliance can have internal ramifications within organisations. Employee morale and job satisfaction may suffer as a result of the negative repercussions of non-compliance. Furthermore, failures in compliance can destroy confidence between management and employees, as well as among team members. Organisations may also experience difficulties attracting and maintaining brilliant workers who want to work in ethical and compliant environments.

iii. Loss of Market Opportunities

Fines for non-compliance could affect an organisation's market potential. Some clients or consumers may reject doing business with companies that have a history of non-compliance, preferring to collaborate with organisations that prioritise ethical standards and regulatory compliance. Non-compliant organisations may also be barred from participating in government contracts, industry groups, or certifications requiring rigorous compliance criteria. This exclusion could end up in forfeited company opportunities and hampered growth possibilities.

iv. Organisational Disruptions

Organisations may need to undertake operational adjustments to ensure compliance and avoid future fines. This can include creating new rules, processes, or systems, recruiting compliance personnel, performing internal audits, or investing in training and education programs. These changes may interrupt existing workflows, necessitate extra investments, and increase administrative responsibilities. Failure to adjust operations to comply with rules can expose firms to additional fines and penalties.

v. Financial Costs

Compliance fines can have a significant financial impact on enterprises. The severity of the infringement and the applicable regulations will determine the amount of the fine. Heavy fines can be detrimental to the financial viability of some businesses, particularly small and medium-sized corporations. Organisations may need to dedicate significant resources to pay the fines, which could result in decreased profitability, liquidity issues, or even bankruptcy in extreme situations.

Major AML Regulatory Bodies And Key Responsibilities

Let’s take a look at some of the key AML regulatory bodies and their respective responsibilities:

a. Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) is the country's financial intelligence unit in charge of discovering, preventing, and deterring money laundering, terrorist financing, and other risks to Canada's security. It is an independent institution that reports to the Minister of Finance.FINTRAC combats money laundering and terrorist financing in the following ways.

i. Analysis and Dissemination

FINTRAC analyzes the information it gets from reporting entities and other sources to produce financial intelligence reports. It provides pertinent information to law enforcement, national security agencies, and other partners in order to aid investigations and protect Canada's security.

ii. Complaince Enforcement

FINTRAC oversees the compliance of reporting entities with AML/CTF legislation and standards. It has the authority to take enforcement action against entities that fail to meet their reporting responsibilities or have flaws in their anti-money laundering and counter-terrorism financing (AML/CTF) programs.

iii. Public Outreach and Awareness

FINTRAC organises outreach initiatives to inform reporting entities and the general public about their roles in combatting money laundering and terrorism financing.

b. Financial Action Task Force

FATF was established in 1989 to be an intergovernmental organisation to combat money laundering and terrorist financing. The organisation sets international standards and recommendations for AML and CFT (combating the financing of terrorism) measures and evaluates the countries’ compliance with the standards that they are subjected to, based on jurisdiction and consumer demographics. FATF on its site described itself as the global money laundering and terrorist financing watchdog. It exercises its watchdog duties in the following ways.

i. Issuing and Implementing Recommendations

The FATF recommendations (2012) amended (2023), is a series of regulative recommendations that are international standards for combating money laundering, terrorism funding and proliferation financing. The recommendations cover areas that include; customer due diligence, record keeping, reporting of suspicious transactions and international cooperation.

ii. Mutual Evaluations

Mutual evaluations by FATF are in-depth country reports that analyse the implementation and effectiveness of measures to combat money laundering, terrorist and proliferation financing. It involves peer evaluations, and members from different countries assess another country. This evaluation process involves performing an in-depth review of a country's AML/CFT system, identifying areas of strength and weakness, and putting forward recommendations for improvement.

iii. Providing Guidance And Best Practices

Aside from the 40 Recommendations, the FATF also offers recommendations and best practices to help countries in implementing effective AML/CFT measures. This advice addresses a variety of issues, including virtual assets, proliferation financing, and risk-based methods. This could be in publications or circulars that all be found on the FATF website.

iv. Partnership With Public and Private Sectors

FATF works with a variety of stakeholders, including governments, financial institutions, law enforcement agencies, and non-profit organisations, to efficiently solve AML/CFT concerns. It encourages the public and private sectors to collaborate in identifying and mitigating risks.

v. International Cooperation Promotion

FATF promotes international collaboration among member and non-member nations in the fight against cross-border money laundering and terrorism financing. This includes information exchange, investigation coordination, and assistance in the recovery of criminal assets.

vi. Staying Updated ToTechnological Advancement

FATF recognises the necessity of staying current with technical innovations such as virtual currencies and other innovative financial products and services. It offers guidance and advice for dealing with the AML/CFT concerns associated with these technologies.

c. Financial Crimes Enforcement Network (FinCEN)

FinCEN is a world-leading financial regulatory body, it serves as a US Department of Treasury bureau charged with combating money laundering, terrorism funding, and other financial crimes. FinCEN is vital in protecting the integrity of the US financial system and assisting global efforts to prevent illegal financial activities. Below are some of the functions of FinCEN:

i. Bank Secrecy Act (BSA) Compliance

FinCEN enforces compliance with the Bank Secrecy Act, a legislation of the United States government that imposes AML/CFT obligations on various financial institutions and businesses. It covers areas such as customer due diligence, record-keeping, reporting, and establishing comprehensive AML programs.

ii. Suspicious Activity Reporting (SARs)

FinCEN requires financial institutions and some categories of businesses to file Suspicious Activity Reports (SARs) when they suspect or have reason to believe that a transaction or activity may be related to money laundering or other financial crimes. These reports are essential for identifying and investigating possible money laundering activities.

iii. Currency Transaction Reports (CTRs)

FinCEN collects and processes CTRs filed by financial institutions for cash transactions over a certain threshold. CTRs aid in the tracking and identification of potential money laundering and other criminal financial operations involving large sums of cash.

iv. Financial Intelligence Gathering

FinCEN is the United States' financial intelligence unit (FIU). It gathers, analyses, and disseminates financial intelligence on questionable transactions, money laundering, and terrorism financing. Certain transactions, including as significant cash transactions, suspicious activities, and international fund transfers, must be reported to FinCEN by financial institutions and other covered entities.

d. European Banking Authority (EBA)

The European Banking Authority works to make sure that there is effective and consistent prudential regulation and supervision in the European banking sector. The agency combats money laundering and terrorism financing by;

i. AML/CFT Guidelines and Standards

The EBA develops AML/CFT guidelines, technical standards, and recommendations for credit institutions (banks), payment institutions, electronic money institutions, and other financial institutions operating in the EU. These rules aim to guarantee that financial institutions have strong anti-money laundering/counter-terrorism financing policies, processes, and controls in place.

ii. Risk Assessments and Supervisory Reviews

The EBA conducts risk assessments and supervisory reviews of anti-money laundering/counter-terrorism financing systems in EU member states and financial institutions. These analyses aid in the identification of potential flaws and vulnerabilities in AML/CFT systems, as well as informing the development of best practices.

iii. Playing an Advisory Role

The EBA advises the European Commission on AML/CFT issues and helps to create EU legislative proposals targeted at strengthening the EU's AML/CFT system.

e. Australian Transaction Reports and Analysis Centre

The Australian Transaction Reports and Analysis Centre is responsible for tracking financial transactions to detect money laundering, organised crime, tax evasion, welfare fraud, and terrorism financing. Some of the following duties are executed by AUSTRAC to combat money laundering include:

i. AML/CFT Regulatory Oversight

AUSTRAC is in charge of regulating and ensuring compliance with Australia's anti-money laundering and counter-terrorist financing laws and regulations. It establishes the regulations and standards that reporting entities such as banks, financial institutions, casinos, and other enterprises must adhere to in order to avoid money laundering and terrorism financing.

ii. Fianacial Intelligence

AUSTRAC collects, saves, and analyses financial intelligence in order to uncover patterns and trends that may indicate money laundering, terrorism financing, or other financial crimes. To aid investigations and prosecutions, the centre distributes this information to law enforcement agencies, security agencies, and other local and international partners.

iii. Reporting and Analysis

Reporting organisations must send a variety of reports to AUSTRAC, such as suspicious matter reports (SMRs) and threshold transaction reports (TTRs). When a reporting company suspects or has reasonable grounds to suspect that a transaction or conduct is related to money laundering or terrorism funding, an SMR is filed. TTRs are submitted for physical money transactions that exceed a certain threshold. This financial intelligence is analysed by AUSTRAC to identify suspected illegal actions.

iv. Risk Evaluation and Guidance

AUSTRAC performs risk assessments in several areas of the economy to identify money laundering and terrorism financing issues. AUSTRAC gives recommendations to reporting companies on how to successfully implement risk-based AML/CFT procedures based on these evaluations.

vi. Penalties and Enforcement

AUSTRAC has the ability to take action against non-compliant reporting organisations. To guarantee compliance with AML/CFT obligations, civil penalties, enforceable undertakings, and judicial injunctions may be imposed.

How to Achieve Compliance with Youverify

Here is a step-by-step process on how businesses can automate their compliance processes with the Youverify workflow builder:

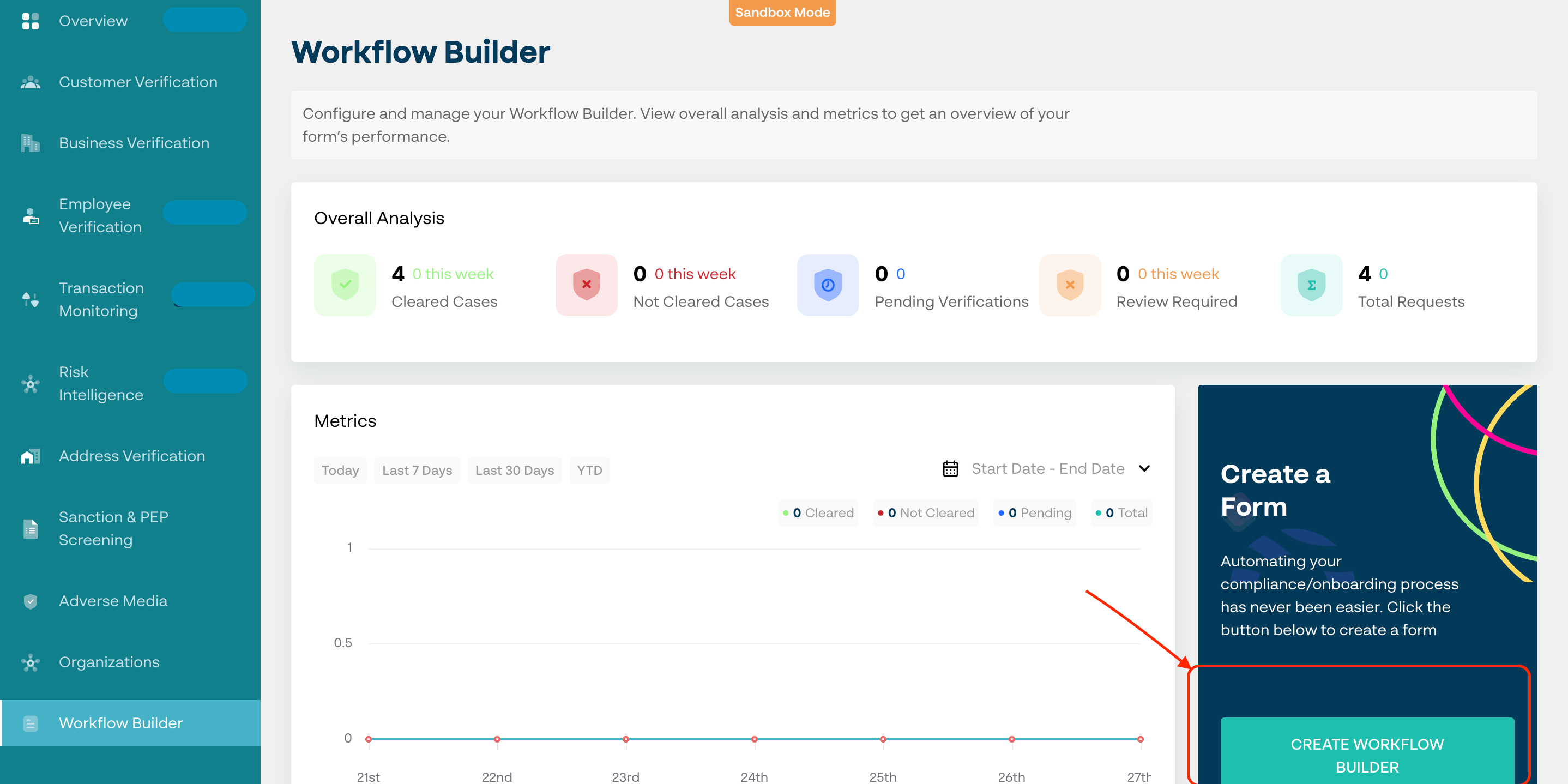

Step 1: Login to your dashboard and navigate to “Workflow Builder” at the left tab of your screen. Select create workflow builder on the bottom right as seen in the image below.

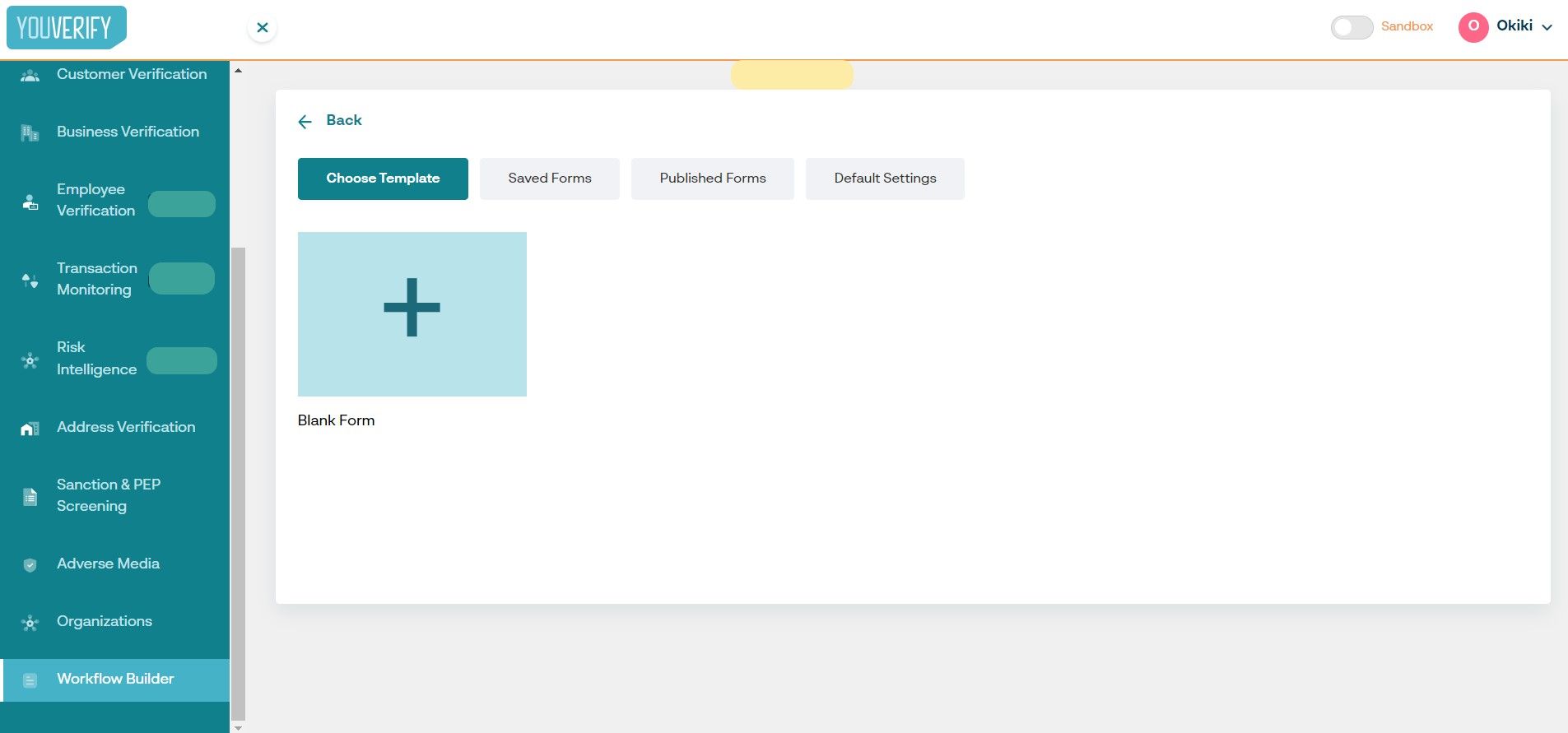

Step 2: You can either opt to choose an existing template by selecting “Choose Template”, Select a designed form draft in “Saved Forms”, copy a previously created and deployed form in “Publish Forms” or edit the template preferences in "Default Settings" tab.

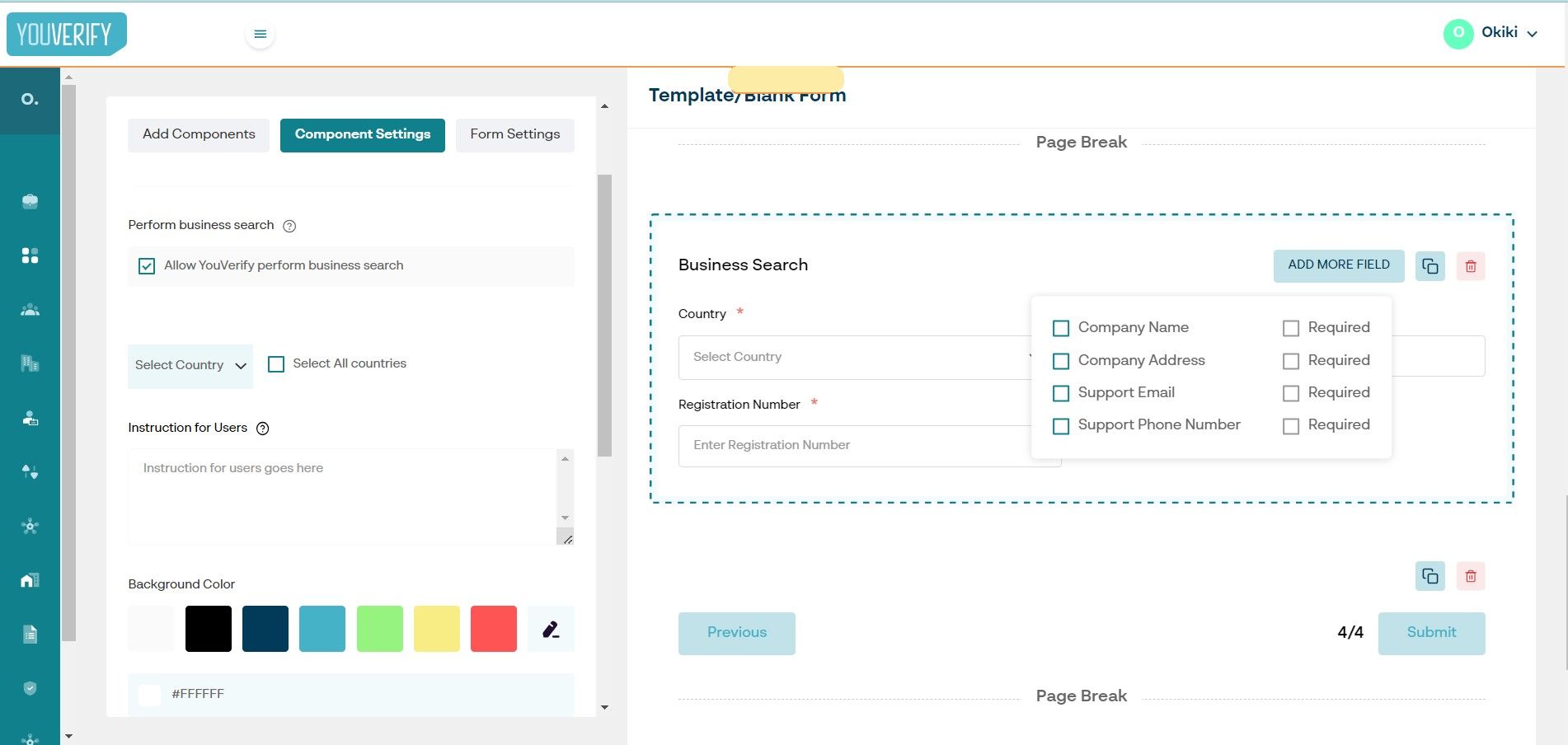

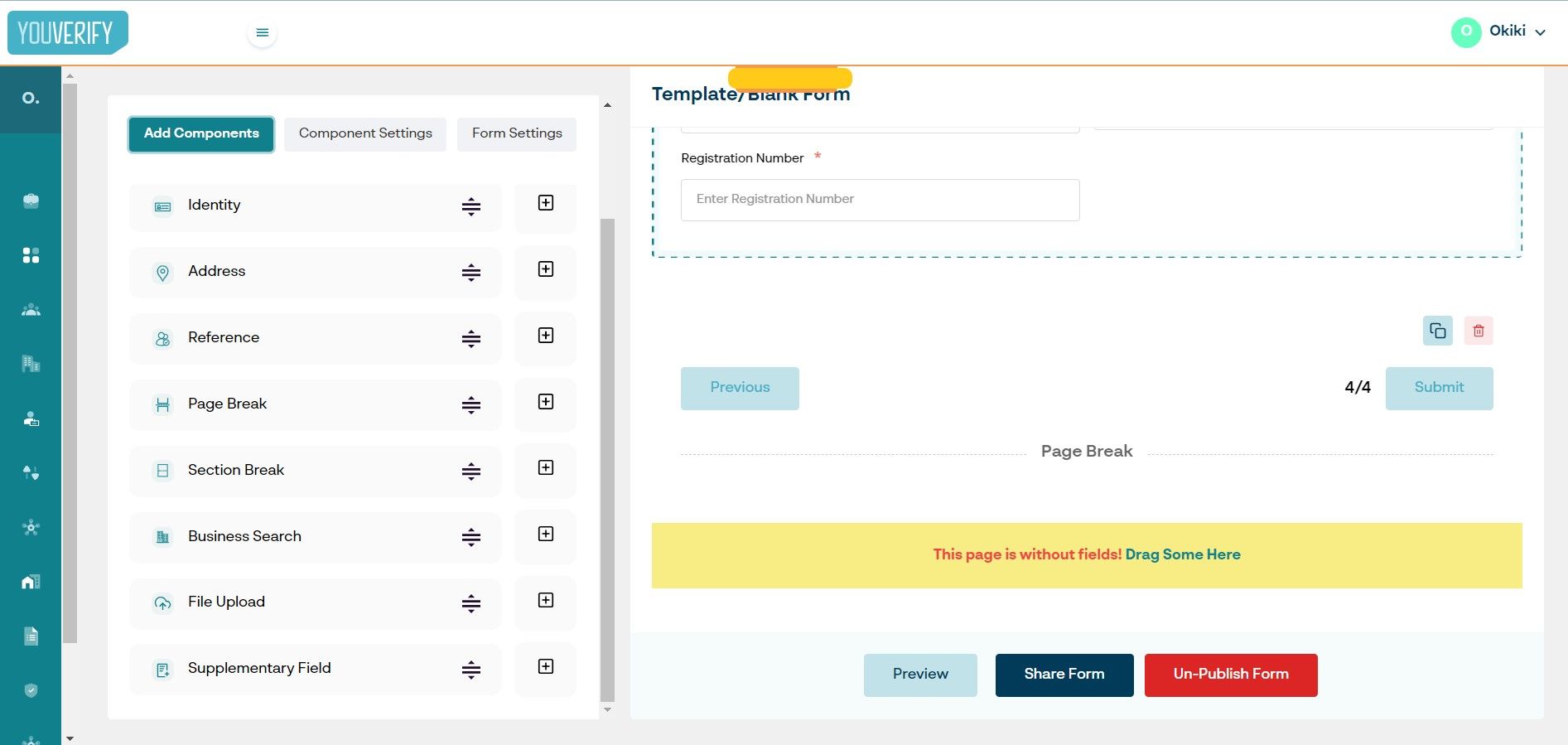

Step 3: Select the solution components necessary for your business compliance needs as indicated in “1” and tailor the user onboarding flow to your preference.

Step 4: Customise individual components to your business brand feel including colours, logo, background, etc.

Step 5: Review to ensure it satisfies all the important needs in your onboarding and publish. You can proceed to share a link directly with customers.

Read: How Youverify Makes Fintrac and RPAA Compliance a Breeze for Canadian Businesses

Bottom Line

Regulatory bodies, also known as oversight bodies, are level field players and will always play important roles in the fintech industry, particularly in curbing gross incompetence, ensuring the protection of consumer data, ensure fair competition, transparency, and ethical conduct. One of the common and prominent ways Regulatory bodies punish financial entities is by imposing compliance fines, which are an added cost to operational costs, thereby promoting compliance cultures and strategies.

See how 100+ leading companies use Youverify for KYC and AML screening of customers for regulatory compliance and real-time risk detection. Request a demo today.