In the dynamic landscape of banking and finance, regulatory compliance has become an increasingly vital aspect of operations. Financial institutions face numerous challenges in ensuring compliance with evolving regulations, preventing financial crimes, and protecting their customers' data. In this article, we will explore some of the key compliance challenges in banking and finance and how Youverify, a leading provider of identity verification and compliance solutions, addresses these challenges with its innovative technologies.

What Are Some of The Challenges Financial Institutions Face In Ensuring Compliance With Evolving Regulations?

Financial institutions face several challenges in ensuring compliance with evolving regulations. Here are some key challenges they encounter:

1. Rapidly Changing Regulatory Landscape

Financial regulations are constantly evolving to address emerging risks and vulnerabilities in the industry. Keeping up with the frequent changes and interpreting new requirements can be a significant challenge for financial institutions. They must dedicate resources to monitoring regulatory updates, understanding their implications, and implementing necessary changes to remain compliant.

2. Complexity and Volume of Regulations

Financial institutions operate in a complex regulatory environment with multiple overlapping regulations and guidelines. These include anti-money laundering (AML), know your customer (KYC), data privacy, consumer protection, cybersecurity, and more. Compliance departments must navigate through these intricate regulations and ensure that appropriate policies, procedures, and controls are in place to address each requirement adequately.

3. Lack of Standardization

Regulations and compliance requirements may vary across jurisdictions, making it challenging for multinational financial institutions to maintain consistent compliance practices. Each jurisdiction may have its own unique set of rules, reporting requirements, and disclosure obligations. Ensuring consistency and adherence to diverse regulations across different regions can be resource-intensive and complex.

4. Compliance Costs

The cost of compliance can be significant for financial institutions, particularly smaller organizations with limited resources. Compliance efforts require investments in technology infrastructure, staff training, monitoring systems, and external audits. Balancing the costs of compliance with the need to remain profitable and competitive can be a delicate task.

5. Data Management and Privacy

Compliance with regulations often involves handling large volumes of sensitive customer data. Financial institutions must ensure robust data management practices, including data protection, secure storage, and appropriate sharing protocols. Stricter data privacy regulations, such as the General Data Protection Regulation (GDPR), further complicate compliance efforts and necessitate comprehensive data protection measures.

6. Technology and Innovation

The rapid advancement of technology presents both opportunities and challenges for compliance. Financial institutions must adopt and adapt to new technologies to improve efficiency and effectiveness in compliance processes. However, integrating new systems, ensuring their compatibility with existing infrastructure, and managing potential cybersecurity risks associated with technological innovations can pose challenges.

7. Globalization and Cross-Border Compliance

Financial institutions operating across borders face additional compliance challenges. They must comply with regulations in multiple jurisdictions, address cross-border transaction monitoring, manage international sanctions, and navigate the complexities of different legal systems and regulatory expectations. Harmonizing compliance practices across different jurisdictions while maintaining local regulatory requirements can be demanding.

8. Compliance Culture and Employee Training

Instilling a strong compliance culture throughout the organization and ensuring employees are aware of their compliance responsibilities is crucial. Conducting regular training programs, fostering awareness of regulatory changes, and promoting ethical behaviour are ongoing challenges in maintaining a robust compliance framework.

To address these challenges, financial institutions can invest in technology solutions, such as compliance management systems and automation tools, establish strong compliance frameworks, and foster a culture of compliance throughout the organization. Collaborating with industry associations, engaging with regulatory bodies, and staying informed about industry best practices can also help institutions navigate the evolving regulatory landscape more effectively.

Read: Key Compliance Challenges for NBFIs and How Youverify Solution Addresses Them

Youverify Solutions And How They Can Help Your Business Or Institution

Youverify has a plethora of services that will save you tons of money, and time. Here are some of them:

a. Know Your Customer (KYC) and Anti-Money Laundering (AML) Compliance

One of the primary compliance challenges in the industry is meeting stringent KYC and AML requirements. Banks and financial institutions must verify the identity of their customers, monitor transactions for suspicious activities, and report any potential money laundering or terrorist financing. Certain documents are required to carry out this process. Youverify offers advanced identity verification solutions that leverage artificial intelligence and machine learning algorithms to accurately verify the identities of customers in real-time.

Other products under these categories are biometrics verification, Liveness Detection, Bank Account Verification, Phone Intelligence & VerificationCustomer Credit Check and PEP & Sanction Screening. This helps institutions streamline their KYC processes, reduce manual effort, and enhance compliance with AML regulations.

b. Know Your Customer (KYB)

KYB refers to the process of verifying the identity and legitimacy of business entities to mitigate risks associated with fraud, money laundering, and other financial crimes. Youverify's KYB service leverages advanced technologies, data analytics, and extensive data sources to provide comprehensive business verification solutions to financial institutions and businesses globally.

Some benefits of Youverify's KYB Service include enhanced Compliance, Improved Risk Management, Increased Operational Efficiency, and Enhanced Security and Fraud Prevention.

c. Know Your Transaction (KYT)

Youverify's Know Your Transaction (KYT) service is a comprehensive solution designed to empower businesses with robust transaction monitoring and compliance capabilities. By leveraging advanced technologies such as real-time monitoring, risk scoring models, and machine learning algorithms, Youverify's KYT service enables businesses to proactively detect and mitigate potential risks associated with financial crimes, fraud, and money laundering.

With features including watchlist screening, behavioural analysis, and case management, businesses can enhance their compliance efforts, improve risk management, and ensure regulatory adherence.

By providing timely alerts, accurate risk assessments, and seamless integration with existing systems, Youverify's KYT service enables businesses to navigate the complex landscape of transaction monitoring with efficiency, confidence, and peace of mind. Read more about the benefits of Youverify KYT.

d. Fraud Prevention and Detection

Financial fraud poses a significant risk to both institutions and customers. Cybercriminals continuously develop sophisticated techniques to exploit vulnerabilities in banking systems. Youverify's fraud prevention solutions utilize advanced analytics and risk-scoring models to detect and prevent fraudulent activities. These solutions analyze transaction patterns, customer behaviour, and contextual data to identify potential fraud in real-time, enabling prompt intervention and minimizing financial losses.

e. Data Privacy and Protection

With the increasing frequency of data breaches and the enactment of stricter privacy regulations like the General Data Protection Regulation (GDPR), data privacy and protection have become critical compliance concerns. Youverify prioritizes data security and privacy by implementing robust measures to safeguard sensitive customer information. Their solutions are designed to adhere to international data protection standards, ensuring secure handling and storage of personal data while maintaining compliance with relevant regulations.

f. Regulatory Compliance Monitoring and Reporting

Staying compliant with the ever-changing regulatory landscape is a complex task for financial institutions. Youverify offers comprehensive compliance monitoring and reporting tools that enable organizations to track and manage regulatory requirements effectively. These solutions automate compliance checks, provide real-time monitoring of regulatory changes, and generate audit-ready reports, streamlining the compliance process and reducing the risk of non-compliance penalties.

g. Customer Experience and Onboarding

While ensuring compliance is crucial, it should not come at the expense of a positive customer experience. Lengthy and cumbersome onboarding processes can frustrate customers and deter potential clients. Youverify's solutions prioritize a seamless and frictionless customer onboarding experience. By leveraging advanced technologies such as biometric authentication, document verification, and automated workflows, Youverify simplifies and accelerates the onboarding process while maintaining compliance and security.

h. Enhanced Due Diligence (EDD)

Certain customers and transactions require enhanced due diligence to mitigate risks associated with money laundering, fraud, or politically exposed persons (PEPs). Youverify's EDD solutions help financial institutions conduct thorough risk assessments by accessing comprehensive data sources and providing advanced risk profiling capabilities. This enables institutions to make informed decisions regarding high-risk customers, ensuring compliance with regulatory requirements.

Compliance challenges in banking and finance are complex and ever-evolving. The effects of non-compliance abound. However, innovative solutions provided by Youverify offer a comprehensive approach to address these challenges effectively.

How to Automate Compliance with Youverify

Here is a step-by-step process on how businesses can automate their compliance processes with the Youverify workflow builder:

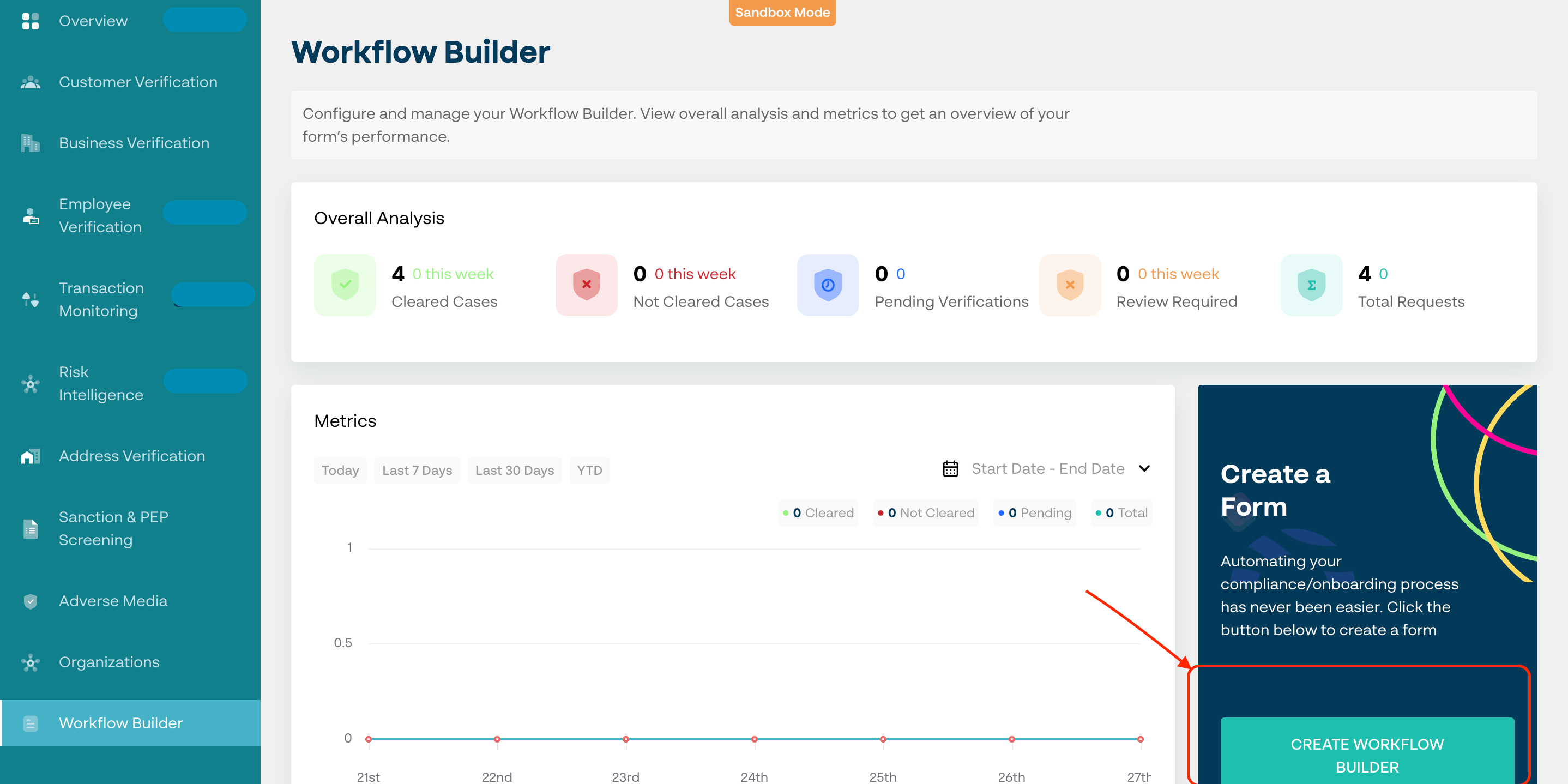

Step 1: Login to your dashboard and navigate to “Workflow Builder” at the left tab of your screen. Select create workflow builder on the bottom right as seen in the image below.

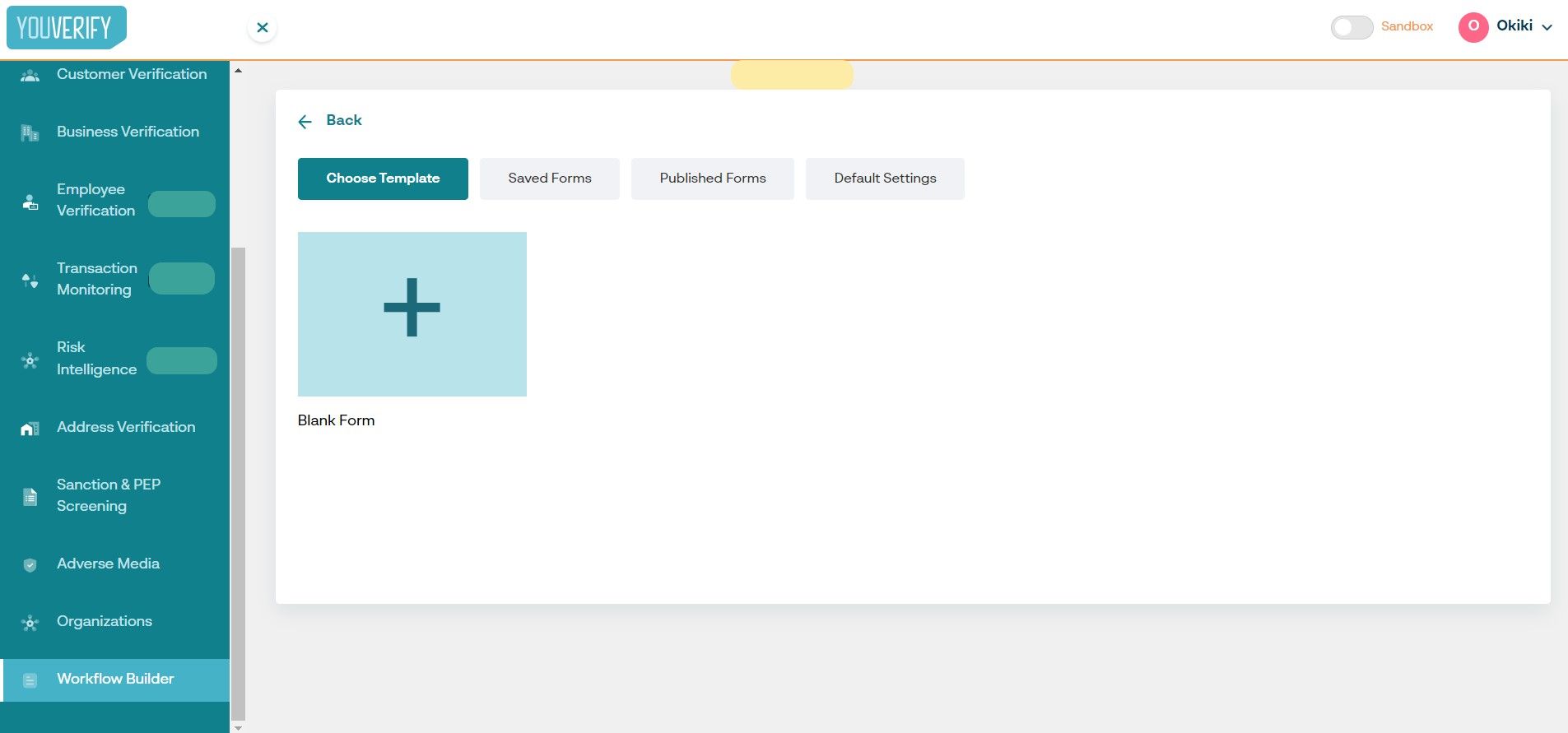

Step 2: You can either opt to choose an existing template by selecting “Choose Template”, Select a designed form draft in “Saved Forms”, copy a previously created and deployed form in “Publish Forms” or edit the template preferences in "Default Settings" tab.

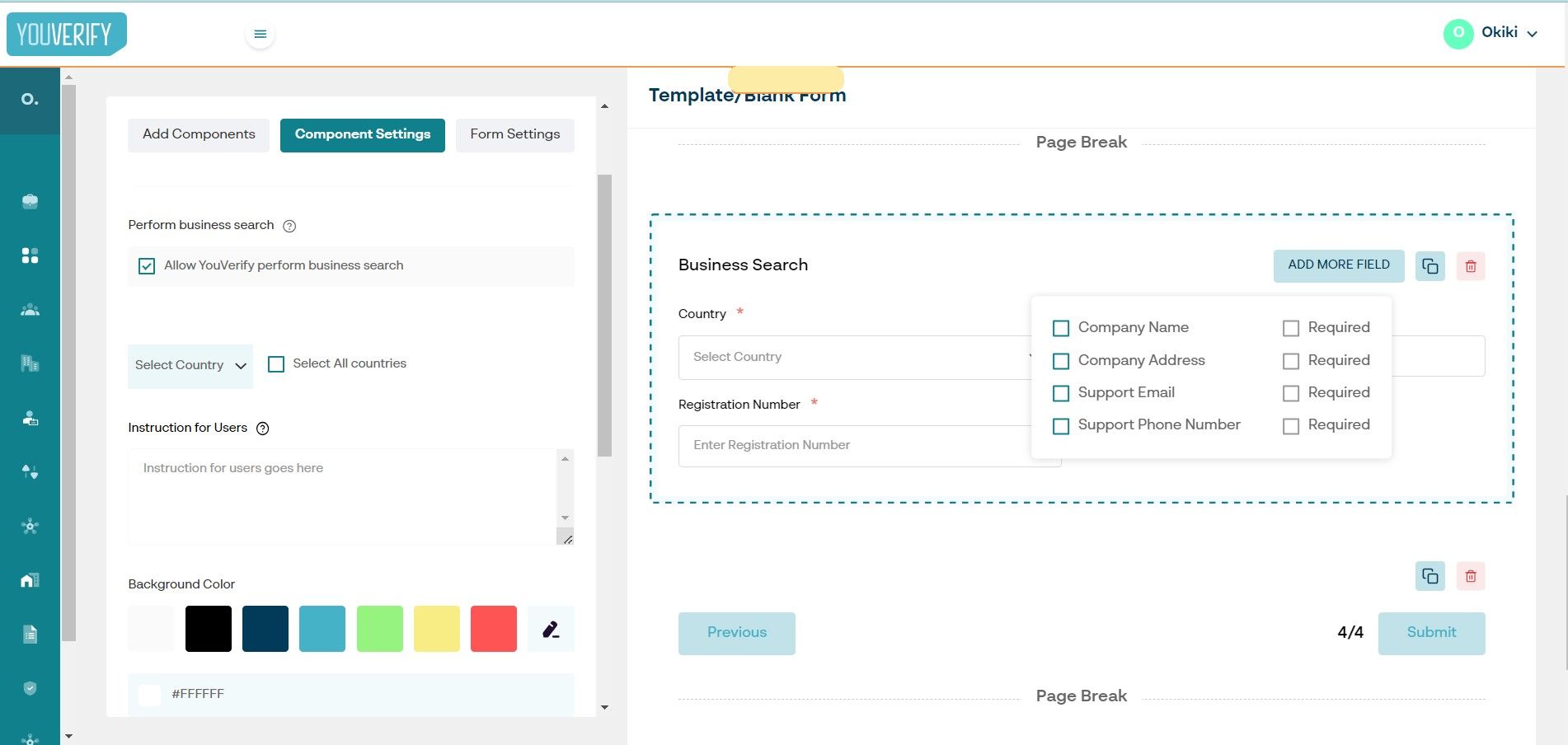

Step 3: Select the solution components necessary for your business compliance needs as indicated in “1” and tailor the user onboarding flow to your preference.

Step 4: Customise individual components to your business brand feel including colours, logo, background, etc.

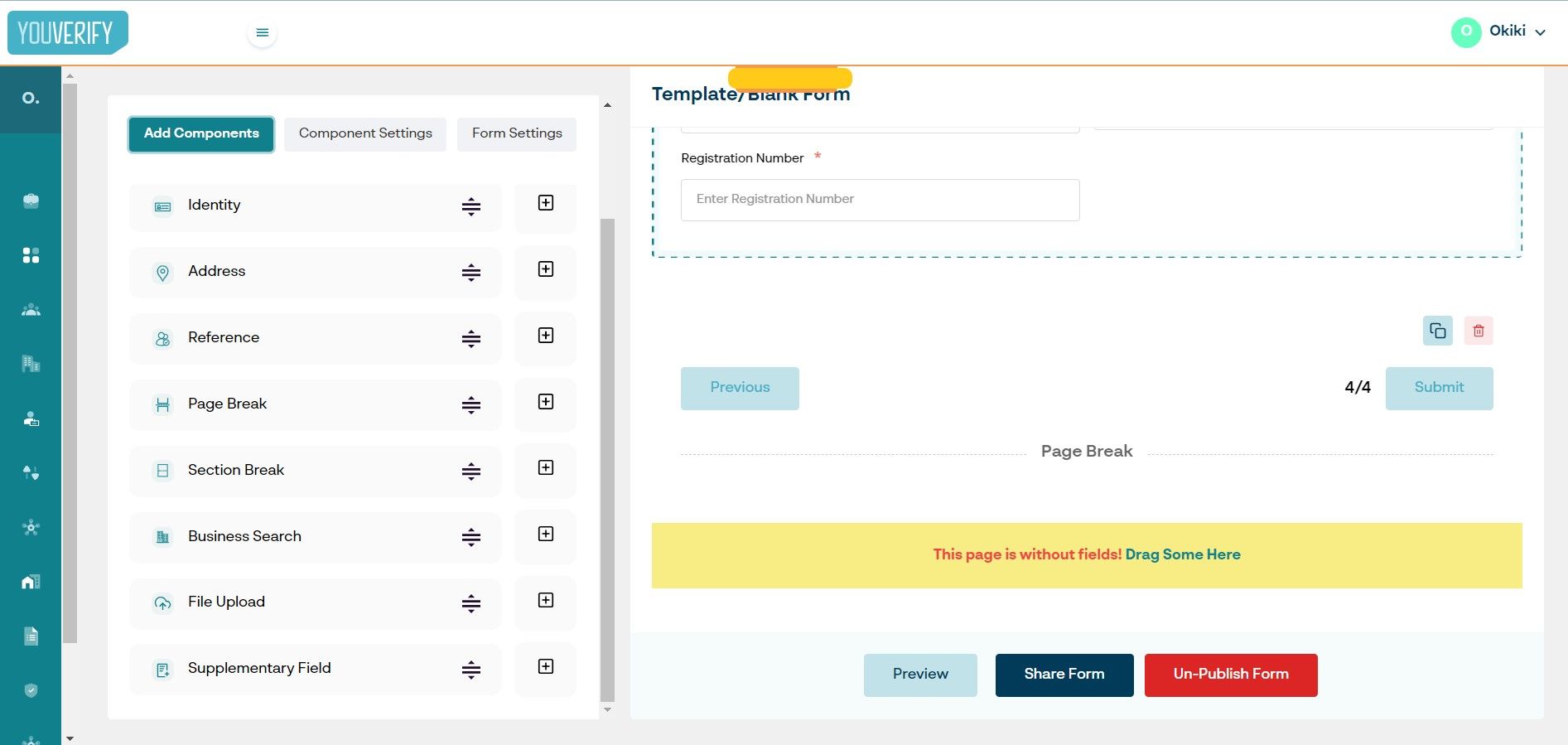

Step 5: Review to ensure it satisfies all the important needs in your onboarding and publish. You can proceed to share a link directly with customers.

From streamlined KYC and AML compliance to robust fraud prevention measures, data privacy protection, and customer-centric onboarding experiences, Youverify's solutions enable financial institutions to navigate the compliance landscape with confidence.

By leveraging advanced AI, machine learning, and reliable global databases, Youverify empowers organizations to meet regulatory obligations efficiently while mitigating risks and enhancing their overall compliance posture in the banking and finance sector. Try a product.