Beyond doubt, startups are now taking the world by storm and have become quite popular for providing innovative digital tools that enhance convenience in financial transactions and processes. Finance startups are revolutionising the finance industry by offering new avenues for individuals and businesses to manage their finances, make transactions, and access financial services.

Making financial transactions easily accessible and significantly less complicated. Finance Startups are thriving in most developed and developed countries, and of course, the United States is not an exception. Building a Finance Startup in the United States can be a rewarding effort, as there is a vast audience that can be promptly targeted, providing solutions and convenience. The Fintech industry is in a boom that will not be in a decline anytime soon, the global Fintech Market was valued at 133.84 billion in the year 2022 and has been estimated to reach a value of USD 556.58 billion by the year 2030. Starting one is not rocket science; it can be achieved with tact, strategy, a competent team, and, of course, capital.

This article serves as a simple yet coherent ultimate guide to building a finance Startup in the US. one thing every interested founder or budding should know is that starting up does not simply start with building the app without any basis, market research or networking, or making tactful decisions.

Ultimate Steps To Take To Build A Finance Startup In The United States

Here is a step-by-step guide on how to build a finance startup in the US:

Step 1. Decipher An Idea

The first question to ask would be, what the product idea is? It does not have to be entirely unique. However, a product idea may be an attempt to meet a gap in the market or to cater to specific audiences that have not been targeted earlier regarding finance. Identify a problem or a gap, and endeavour to fulfil it with the vision of your idea.

Once a clear product idea is deciphered, then the next step can be undertaken. Ensure that a thorough research process is taken in order to validate the product idea, refine your value proposition and identify a target audience for the product target audience; this means that a niche should be identified. Your fintech product can make use of fiat and crypto tenders. You also need to consider if the product caters to businesses (B2B) or consumers (B2C).

Services that a fintech product can offer include; neo-banking, money transfers, accounting, insurance, personal finance management, digital lending solutions, lending, trading software or bots, or investment software or bots. In 2021, there were 8775 fintech start-ups in America. This is why it is advisable to have an innovative idea that fills a gap, that profers solutions needed. Ideas may be aligned with the leading fintech products in the market or not. The leading fintech products are those that offer digital payment services, the digital payment segment of fintech was valued at $1.2 trillion in 2021. You may not decide to align your idea with popular product ideas, however, it is important to ensure that your product idea can float.

Step 2: Have A Plan

A business idea or a product idea has to be backed up by a plan; a product idea without a plan can be likened to building a castle in thin air; thorough market research needs to be undertaken with important considerations in mind. Competitive analysis is major research that needs to be undertaken, as well as thorough research of the intended target audience.

Market analysis and competitive analysis are essential components of business research that provide valuable insights into the market landscape and the competitive dynamics within it. Market analysis involves studying the target market, including its size, growth potential, customer segments, and trends. It also includes analyzing customer behaviour and the competitive landscape. On the other hand, competitive analysis focuses specifically on evaluating the competition within the market. It involves identifying competitors, assessing their strengths and weaknesses, and analyzing pricing strategies, product offerings, and marketing tactics.

By conducting both market and competitive analyses, businesses can gain a comprehensive understanding of their market, identify opportunities, develop effective marketing strategies, and make informed decisions to gain a competitive edge.

A tricky part is the regulations part; you need to figure out the regulations and sanctions present in the industry you intend to set into, such as AML and KYC and regulatory bodies. We will discuss more on this in the latter part of this guide.

The bottom line is, it is important that you work with experts in such aspects because this is a sensitive part of every initial planning for a fintech product. Ideally, your best bet will be to leverage advanced compliance automation technology like that of Youverify to fill the gap when it comes to automated decision-making processes like KYC, and AML onboarding. Using automated tools like Youverify can help cut costs and mitigates clashes that come with the fuss of too many staff or personnel looking to make a single decision.

Recommended - How Compliance Solutions Streamline Operations and Improve Efficiency

Step 3: Source For Funds

Of course, product ideas can not properly float without funding or capital; this can be quite tough to set off. Sourcing for funds requires that investors believe in you and your dream or your idea and that your idea has the capability to yield profit, not just profit, but enough profit to be deemed profitable. There are a variety of sources that a founder can get funds, asides from self-funding. These include:

a. Venture Capitalists

Venture capitalists are private equity investors that provide capital to companies that have “high growth potential” in exchange for an equity stake. You will need to research and target Venture capitalists that specialise in fintech or related industries. You can prepare a compelling pitch deck and business plan to capture their interests and protect your business as one that really has high growth potential. Here are some venture capitalists that invest n fintech firms you could consider:

i. ff Venture Capital

This venture capital is located in NYC and Warsaw and has made 14 investments so far, they invest in companies that operate in the Fintech, AI and Robotics sectors. ff Venture Capital typically issues checks between $300k and $700k for its Seed and Series A investments in the chosen companies. This venture capital firm has invested in numerous businesses, some of which include 500px, Deem, Jazz, Livefyre, Omek, Pear, Plated, Quigo, and Ionic.

ii. The Artemis Fund

The Artemis fund is well known in Houston, it is also women oriented and is well known to fund companies led by women, the Artemis fund supports start-ups in tech and e-commerce. Despite providing Seed and Series A finance, this company does not specify the precise investment amount. In addition to the investment, the venture capital firm offers the network and talent assistance that entrepreneurs need to grow quickly and become self-sustaining businesses. This company has so far invested in 16 businesses, including some well-known brands including DRESSX, HopSkipDrive, GoodFynd, Work & Mother, and Green Room.

iii. Secocha Ventures

This venture capital was founded in 2013, and is located in Miami, it is a venture capital that invests in early-age startups, in Fintech, healthcare and consumer products and services. In addition to direct Seed and Series A funding, this venture capital firm actively interacts with the chosen portfolio businesses and offers customized mentoring to aid in their expansion. The company has so far invested in 30 startups, some of which are Sheets & Giggles, 10Club, Bling, Brigit, Bunches, CarePredict, Forbidden Foods, Merlin, Opal, and Bling.

iv. Bertelsmann Digital Media Investments

Bertelsmann Digital Media Investments AKA BDMI is a venture capital firm in Newyork, this venture capital firm provides funding to startups operating in the NextGen Media, Web3, Enterprise SaaS, and Fintech sectors from Seed to Series A+. For Series A+ capital, they typically write a cheque for anything between $500k and $10M. BDMI has so far made investments in 117 businesses, some of which include Antenna, Boostr, Clique, ZergNet, Lemonada, and Astra. Even other venture firms are funded by this venture capital organisation.

v. Accion Venture Lab

Accion Venture Lab is a subsidiary of Accion, which is a global non-profit organisation. It has invested in fifty-five startups so far, since its inception all over the world. Accion Venture Lab only works with Fintech firms and founders and offers Seed to Series A+ financing. The corporation makes up to $1 million in investment in each chosen business. The most well-known Accion Venture Lab portfolio firms include Anthem, Aye, Advance, Aire Labs, Capiter, CashInvoice, and others.

When pitching to a venture capital firm as a fintech startup founder, it's crucial to effectively communicate your vision, value proposition, and market potential in a concise and compelling manner. Start by clearly articulating the problem you're solving and how your solution stands out from competitors. Highlight the scalability and profitability of your business model, showcasing a deep understanding of the target market and its growth potential.

Present a well-defined roadmap outlining your strategy for customer acquisition, product development, and revenue generation. Demonstrate a strong team with relevant expertise, emphasizing their ability to execute your vision. Back your claims with solid data, such as user traction, revenue growth, or industry partnerships, to build credibility. Finally, convey your passion, enthusiasm, and commitment to success, leaving the investors confident in your ability to deliver on your promises.

b. Bootstrapping

This entails using personal resources or money borrowed from friends and family to finance the startup's early stages. Although it gives you total control over your company, this alternative might not have sufficient funding.

c. Angel Investors

High-net-worth individuals can contribute their own funds in exchange for shares to early-stage enterprises. Angel investors frequently offer not only money but also guidance and connections in the sector. While Angel investors may be regarded as a quite rare type of investor to get, getting one might be considered lucky.

Getting an angel investor may not be so difficult. One way to source for angel investors is by networking. Networking means you are a walking business card and a walking business plan. If you need to refine your business plan do that, you never know when you have to lay it all out, even in the most casual ways possible.

Attend industry events, pitch competitions (even if you do not win, you might be approached personally), attend start up meetings or join founder committees too. You can also research angel investor networks and groups, there are many online platforms online that you can utilise, make sure to create a compelling profile online for your startup. You can also seek mentors in your field, which may end up being an investor or may connect you to investors.

d. Crowd Funding

Crowdfunding is also another source of funds that you can explore. It involves raising funds from a large number of individuals using an online platform. Crowdfunding can take several forms, including equity crowdfunding, peer-to-peer financing, and reward-based methods. It can be an avenue for your start up to interact with potential users and audiences as well the potential markets and can also serve as a form of awareness.

e. Strategic Partnership

Your company can collaborate with reputable technology businesses or financial institutions that can offer finance, resources, and market knowledge. it is a way that can ease market entry and provide access to a larger client base.

f. Joining Incubators and Accelerators

Joining fintech-focused accelerator or incubator programs can offer finance, mentoring, networking opportunities, and resource access. These initiatives frequently call for businesses to submit competitive applications and offer assistance in exchange for stock or participation fees. Examples of fintech incubators include; 500 start-ups, founder institutes, seed camps, mass challenges etc.

Getting into incubators and accelerators can be quite tough, however, If you want to increase your chances of being accepted into a fintech incubator, do your research and choose incubators whose objectives are compatible with your startup's. Develop a minimal viable product, leverage your network for connections, and participate in incubator activities. Customize your application, emphasize market traction, show that you can be coached, and be ready for interviews. Be persistent and take a look for mentorship and alternative financial possibilities.

g. Debt Financing

Debt financing is the process of obtaining loans or credit lines from banks or other financial organizations to pay for particular business needs. Compared to equity financing, this method can offer more flexibility and control over equity but may also require collateral and strong credit history.

Related Article - Anti-Money Laundering (AML) Regulations in the UK

Step 4: Prototyping

Once you have a substantial amount of capital to go ahead with the project, you can go ahead to make a prototype; a prototype will help validate your ideas; it is the strings that tether the castle to the ground rather than letting it float on thin air. Your product will always need refining and a series of iterations before it is launched.

A prototype serves the function of its literal meaning, a prototype is the first example of a creation. However a first example is not always perfect, it is like a first draft, and a prototype needs to be a working model. A prototype serves as a working model that demonstrates the core functionalities and user experience of your product.

It helps you identify any flaws or areas for improvement early on, enabling you to iterate and refine your solution before launching it to the market. A prototype is also useful for pitching to investors and can improve your credibility and even your chances of winning them over as they have a tangible reference.

In order to provide a visual representation of the overall structure and layout of your program, wireframing entails drawing simple sketches or blueprints of the primary screens or user interface. However, rapid prototyping goes beyond wireframing by developing an interactive, clickable prototype that mimics the user experience. Rapid prototypes can be altered in response to user feedback, enabling you to better iterate on your design and obtain insightful feedback. It is crucial at this point to involve professionals.

Designers of user experiences (UX) and user interfaces (UI) can assist in making sure that your prototype is aesthetically pleasing, user-friendly, and adheres to design best practices. Their experience can significantly improve your prototype's usability and functionality, resulting in a more marketable final product. Working together with experts can also ultimately save you time and effort.

They may bring their expertise to the table, assisting you in avoiding potential pitfalls and guaranteeing that your prototype faithfully captures your vision. Their advice can help you make wise choices and direct you toward developing a prototype that appeals to your intended audience. The prototype stage is an iterative process, so it's vital to bear in mind that you'll need to gather feedback, make adjustments, and enhance your prototype as you go. This will ultimately result in a product that is more robust and user-focused.

Step 5: Time To Build The App... For a Proof Of Concept.

The app serves as a substantial proof of concept and happens after substantial feedback has been given concerning the prototype, which is enough to incite development. However, a proof of concept (POC is still somewhat of a caricature and is not released to the public. It is not to measure its feasibility and productivity. The proof of concepts performs a literal function, it proves that the product can achieve or perform all that is expected, and designed to do. it serves as an internal tool for further testing, refinement, and investor demonstrations. You will most definitely have the input of crucial professionals like; Software engineers, developers, and quality assurance specialists that can bring your POC to life.

Step 6: Building A minimum viable product

POCs can continue to be developed and worked on until it is deemed suitable enough to release to the public. Once there is a guaranteed success and ultimate convenient use, complete with security and vulnerability checks. Of course, at this stage, funding should also be allocated to marketing campaigns and ads. User engagement and metrics should also be monitored.

Step 7: Keep Iterating

Keep developing your product; this is not the time to shoot down on feedback either. Keep on heeding feedback in order to stay ahead of the marketing product cycle. Keep optimizing the monetization strategy and make sure that the product keeps serving its target audience. Continue to use and gather user insights, conduct user research and analyse customer behaviour, this way you can understand their evolving needs and preferences.

Achieving Compliance For Early-Stage Startups in the US

Compliance is one aspect of every finance-oriented business that should not be ignored, it is very important that founders and entrepreneurs figure out compliance as early as possible. One of the primary reasons is that there are many individuals looking to participate in illicit activities like money laundering and are always looking for conduits.

In fact, compliance requirements should be considered right from the modification of any idea that is conceived, right through prototyping, and proof of concept. Every product will also need to demonstrate to customers that their data is safe and they do not have to worry about security measures being too loose.

A common misconception for most new founders and entrepreneurs is that compliance is only associated with companies that operate at a higher level that has been able to develop products that are well-established and widely used.

Compliance reduces the risk and liability that your product or company is exposed to. So when should you consider compliance as an early start-up? Now is the time, do not wait any longer. While it is critical that defences and compliance are well-developed and capable enough to provide a shield against illegal activities. It should be understood that compliance is an iterative process and can not be all perfect from the start.

Compliance programs can mature as the product matures. The need to be perfect does not have to kill your process of compliance, it is better to start now than start later when you already have an array of breaches and incidents that can cause havoc for your brand.

For an Early start-up, the following measures should be taken:

1. Identify The Compliance Requirements Of Your Product’s Industry

Every industry has unique compliance requirements. For Fintech companies, the compliance regulations are a little different and can be much more stringent as financial entities are held up to higher standards and are also regarded as a sensitive point of entry for the transfer and input of illicit money. The laws that apply to your specific product may also be quite different as well. This is why it is important to make adequate research.

The fintech industry in the United States operates within a compliance framework that may be somewhat complex and highly regulated as well. Compliance regulations also vary according to the services being offered, consumer protection laws may also be different from the varying services, Fintech companies are also under the oversight of the Consumer Finacial Protection Bureau (CFFB) as well as other consumer-oriented bodies. They are required to operate fairly and protect consumer data. There are also AML regulations to consider, such as the;

i. The Bank Secrecy Act (BSA)

Implemented in 1970, comes into play depending on the services offered by your products. Financial institutions are required by the Bank Secrecy Act (BSA) and related anti-money laundering measures to:

- Create efficient customer due diligence systems and monitoring processes; Create efficient BSA compliance operations;

- Screen through various government lists and the Office of Foreign Assets Control (OFAC)

- Create a process for monitoring and reporting questionable activity;

- Create anti-money laundering programs that are risk-based.

ii. The Patriot Act

Passed as an amendment to the Bank Secrecy Act, the Patroit Act was implemented after 9-11. As a means to empower law enforcement agencies when investigating terrorism financing. With an emphasis on overseas transactions, the Patriot Act mandates a variety of customer due diligence (CDD) and screening obligations on US businesses. For anyone caught in violation of CFT compliance standards, the Patriot Act carries both criminal and financial sanctions.

iii. Anti Money Laundering Act (AMLA) 2020

This act was introduced in 2021 and is regarded as a notable reform, in AML/CFT legislation since the Patriot Act was passed into law. The purpose of this act was to manage and mitigate threats that are posed by the new technologies associated with new technologies as well as new and advanced criminal methodologies.

To decipher the certifications that may apply to your company or product you may take a look at your competitor's certifications, and consult professionals, this data is always typically available on websites and can easily be accessible. Traditional compliance can be an overkill and suffocate small startups, however, it is important that you take your time to understand the complaint processes and regulations. The Youverify blog is full of resources that can help you along the way.

2. Develop A Compliance Strategy

Create a plan that is solid as possible, and is dimensional. Let it contain and outline the compliance requirements and goals for your new start-up. Make sure that the most important aspects are prioritised, and make sure to allocate resources accordingly. Consult professionals and seek legal counsel along the way.

3. Ensure That Systems Are In Place To Protect Consumers’ data

The data of users and consumers should be regarded as high-rated information that should be kept away from illicit individuals and hackers. Security should not be handled loosely or be compromised for other aspects, it is one of the important aspects that can make or break your product or company.

4. Internal Policies and Procedures Should Be Established

Internal policies and procedures should be developed and documented. These policies and procedures should align with regulatory requirements for your industry and product or services. This could involve personnel compliance training, data handling regulations, client protection procedures, and anti-money laundering (AML) safeguards.

5. Setup KYC And AML Compliance Structures

Know Your Customer and Anti Money Laundering regulations are non-disposable, as an entity that is involved in giving financial services, especially as a fintech product, service or firm. Implement KYC and AML processes to confirm customer identity, track transactions, and file legally mandated reports for suspicious activity.

6. Automate Your Compliance

Using automated compliance can be a great option for start-ups as it requires a group of lesser personnel. However, you need to use reliable compliance automated tools such as Youverify.

Youverify helps early startups automate their decisions, onboard the right customers and fight fraud using data. Youverify solutions are very easy to navigate and use and is an elaborate platform with which you can integrate your own platform via API or SDK.

While all these measures are very important, you will also need to stay updated on regulatory requirements in your industry as you progress as a company, subscribe to newsletters, follow regular bodies, and constantly seek legal counsel, it is important to have a legal department that can take care of legal issues.

It is also important to conduct regular audits and assessments and employ credible and capable employees related to such departments. Finally, ensure you keep thorough records of compliant efforts or procedures. Documentation will always be important right from the start.

How to Automate Compliance with Youverify

Here is a step-by-step process on how businesses can automate their compliance processes with the Youverify workflow builder:

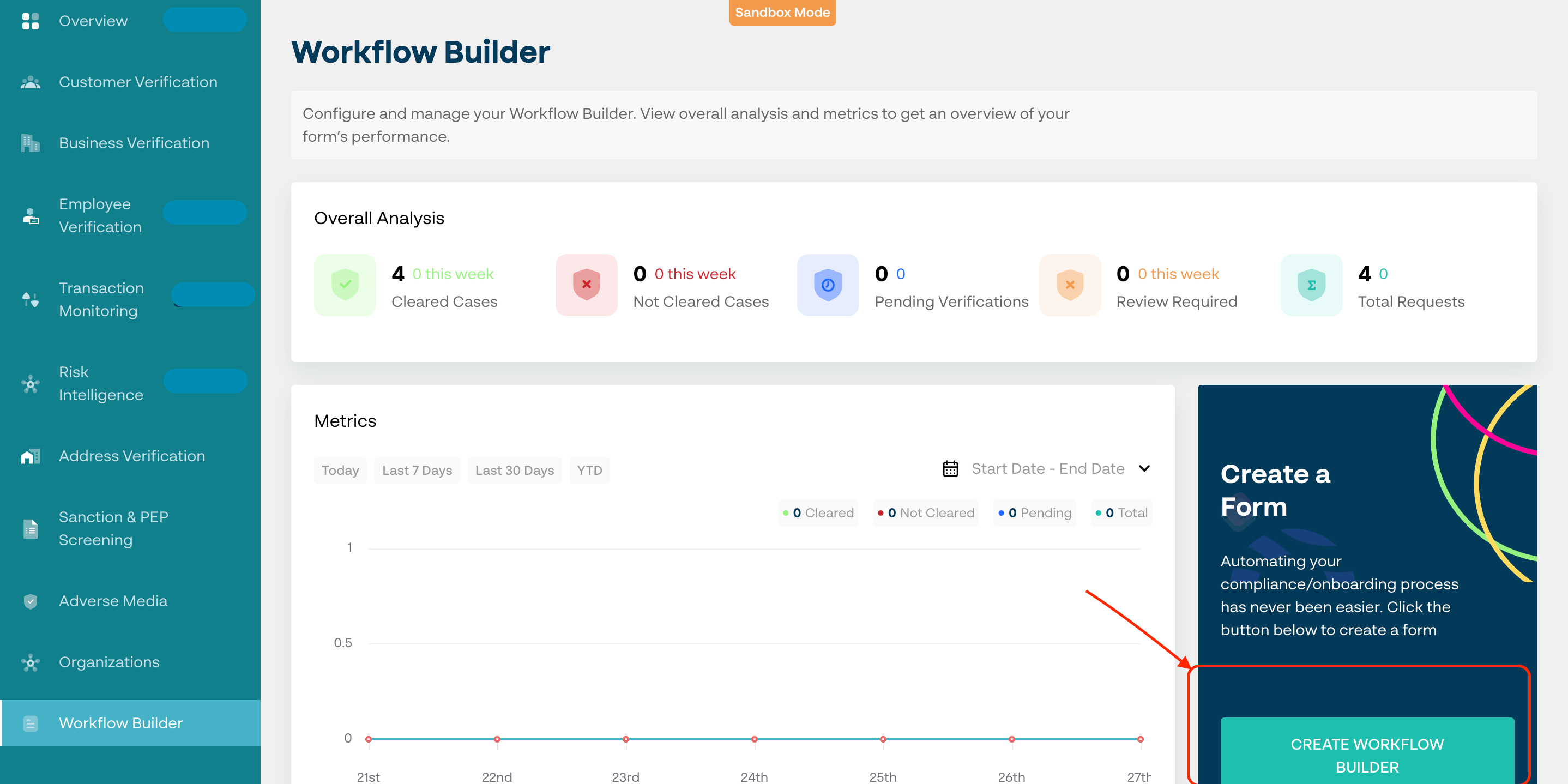

Step 1: Login to your dashboard and navigate to “Workflow Builder” at the left tab of your screen. Select create workflow builder on the bottom right as seen in the image below.

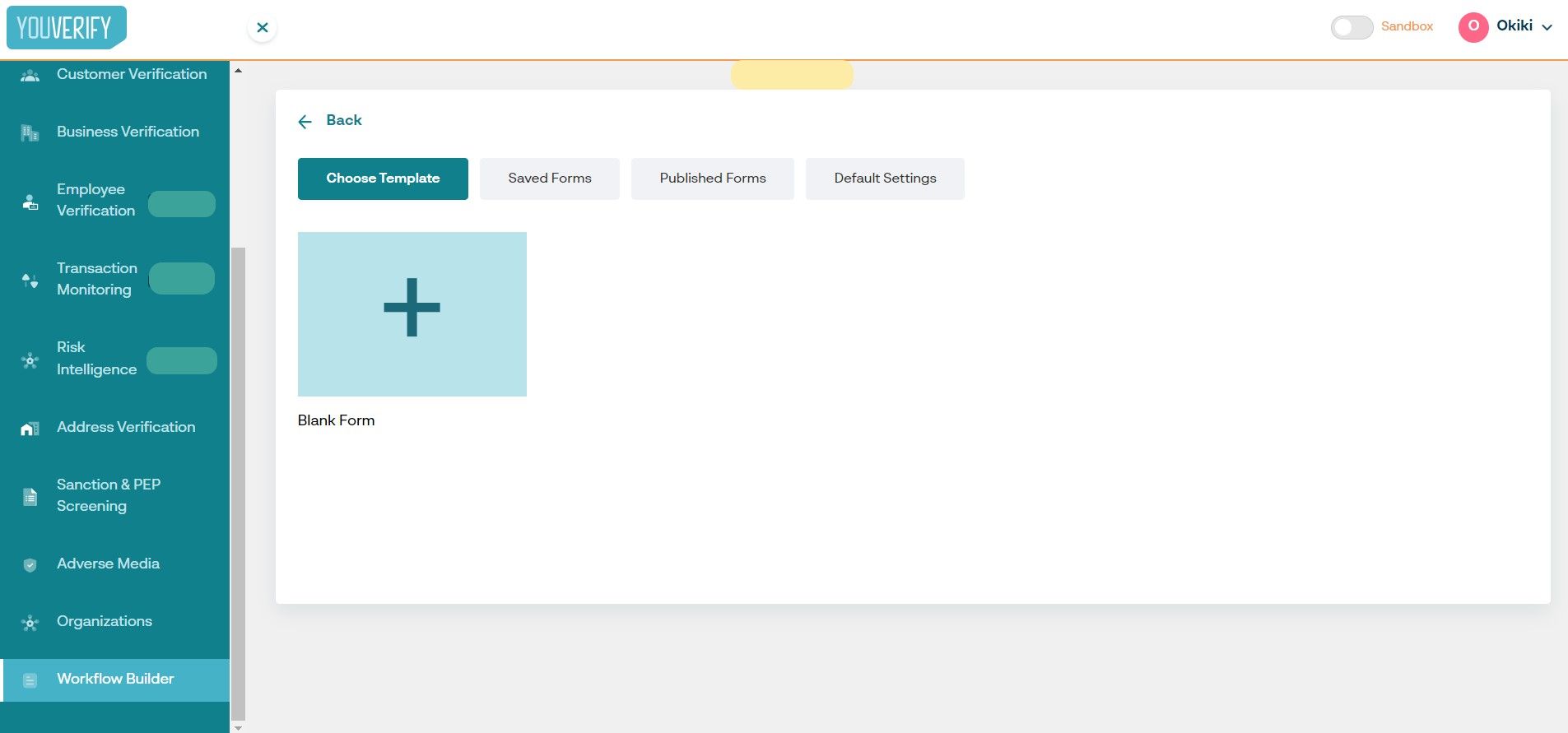

Step 2: You can either opt to choose an existing template by selecting “Choose Template”, Select a designed form draft in “Saved Forms”, copy a previously created and deployed form in “Publish Forms” or edit the template preferences in "Default Settings" tab.

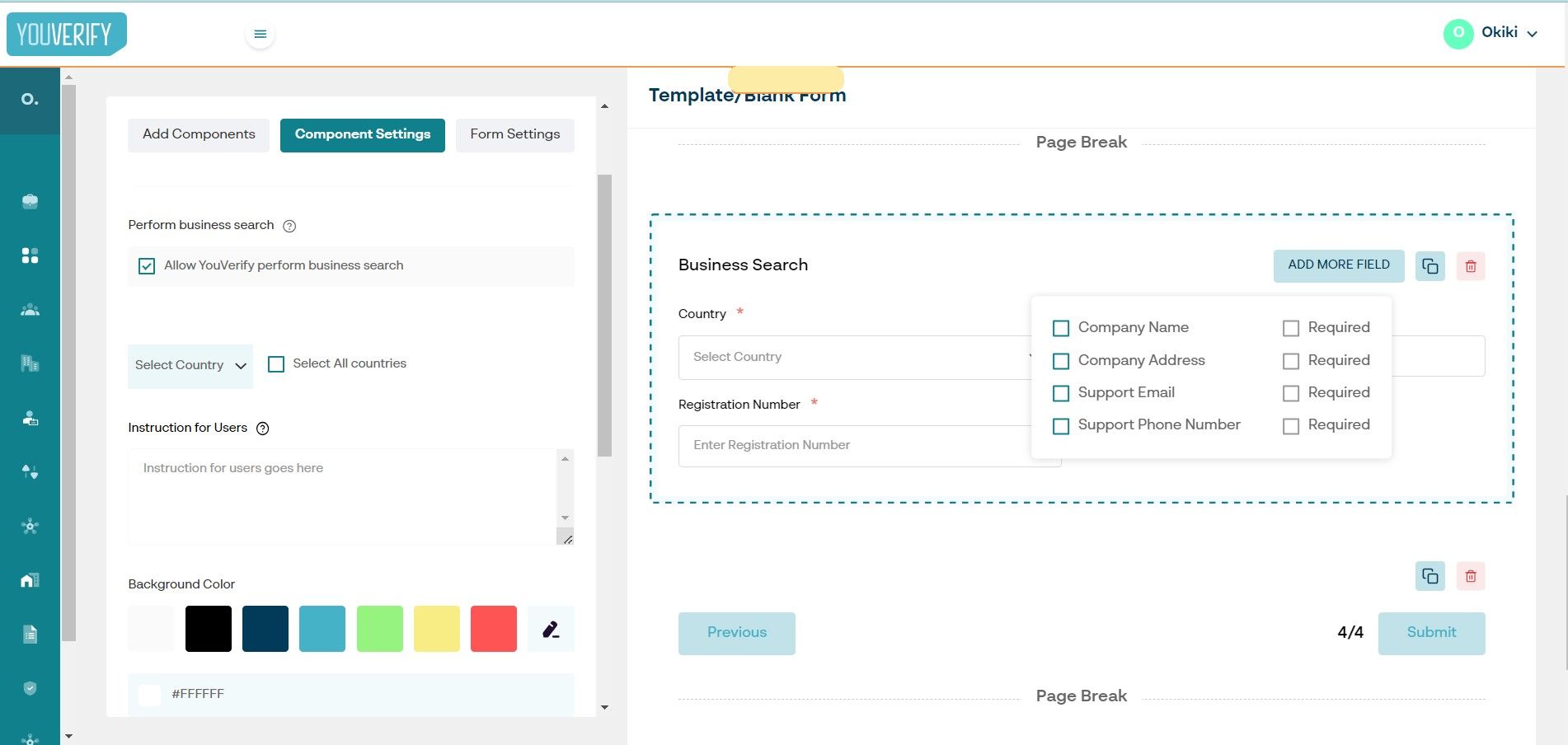

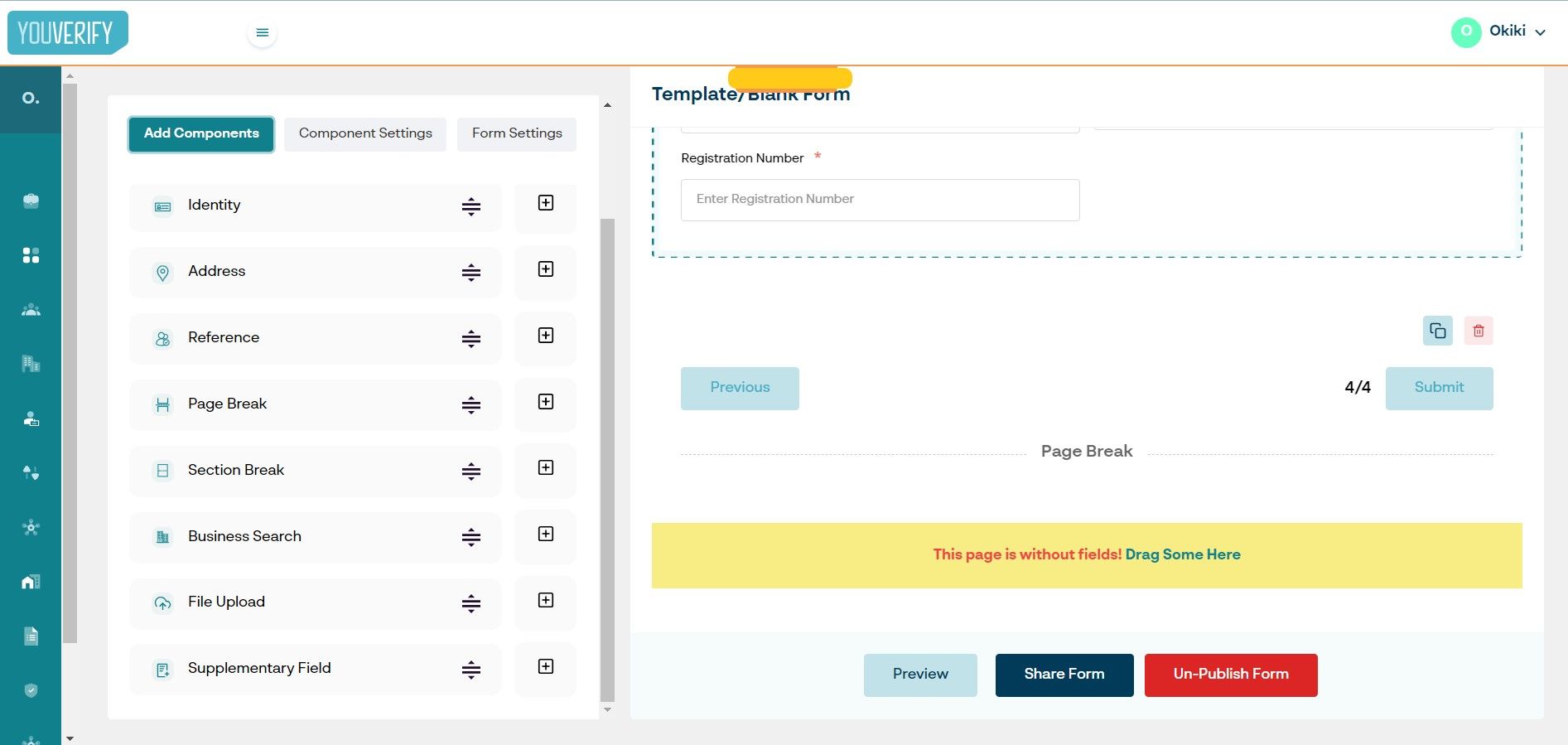

Step 3: Select the solution components necessary for your business compliance needs as indicated in “1” and tailor the user onboarding flow to your preference.

Step 4: Customise individual components to your business brand feel including colours, logo, background, etc.

Step 5: Review to ensure it satisfies all the important needs in your onboarding and publish. You can proceed to share a link directly with customers.

Bottom Line

The journey of building a successful finance startup is an ongoing process. By continuously iterating and improving your fintech product based on user feedback and market dynamics, you can stay ahead of the competition and provide an exceptional user experience. Stay agile, adaptable, and committed to the growth and success of your finance startup.

Remember, compliance is key as one breach can cause reputational damages and fines from regulatory authorities which you may not be able to recover from.

See how 100+ leading startups in the US use Youverify for KYC and AML screening of customers for compliance and real-time risk detection. Request a demo today.