Combating financial crimes committed by politically exposed persons (PEP) starts with identifying them. PEP screening and due diligence help to identify these PEPs who are susceptible to committing financial crimes such as money laundering, and terrorist-sponsoring, hence PEP screening is an important aspect of any financial institution’s KYC/ AML compliance program. Moreover, not complying with these AML laws can lead to penalties by the Financial Action Task Force (FATF).

However, the process of PEP screening can be quite challenging due to several reasons. This article details the challenges of PEP screening and how to overcome them with 5 best practices for PEP screening and due diligence.

What is PEP Screening: How is it done?

PEP screening is the process of identifying individuals who hold important political positions and/or their close associates. These individuals are politically exposed persons (PEPs) and are considered high-risk because of their vulnerability to financial crimes.

PEP screening is an important component of Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance.

PEP screening is done by checking the name of a person against a database of known PEPs to determine if there is a match. If a match is found, the financial institution then goes ahead to conduct enhanced due diligence to assess the associated risk of that individual.

PEP screening tools are important tools for financial institutions to identify and assess risks associated with politically exposed persons (PEPs). These tools use advanced technologies to streamline the PEP screening process and ensure accuracy.

Challenges in PEP Screening

In as much as PEP screening is important in identifying PEPs for a bank’s AML compliance, it is not without some challenges. Accurate PEP screening can be challenging due to several factors:

1. Global Non-Uniformity in PEP Definition:

Across the globe, there are different meanings of PEP and as such this affects how PEPs are identified in different jurisdictions and the way they are screened.

2. The Constant Change in Political Status.

The political space changes very quickly as individuals can attain a position today and lose it the next. This necessitates continuous monitoring and updating of the PEP list, making it difficult to maintain an updated PEP database. Besides, failure of financial institutions to access the newly updated list may lead to non-compliance or exposure to illicit financial activities.

3. Name Variation:

PEPs may use different name arrangements or aliases, making it difficult to identify them.

4. Determining the Risk Level of PEP:

The money laundering and corruption risk level of a PEP is determined by the nature of the PEP’s political position, location, and financial activities. High-risk PEPs require enhanced due diligence and in-depth continuous transaction monitoring while regular PEPs require the basic/ standard due diligence.

5. Overdependence on the PEP List:

Although PEP lists are vital PEP screening tools, they are not sufficient enough to ascertain the risk level and status of a PEP. Additional due diligence is needed to meet regulatory requirements and mitigate compliance risks.

6. Difficulty in Identifying Relationships between PEPs and Close Associates

Determining relationships between PEPs, their family members, and associates can be challenging. Hence, PEPs usually take advantage of these relationships to move illicit funds and launder money. However, there are PEP screening software that can aid in the detection and understanding of the relationship between PEPs and their family.

7. Global Reach:

Identifying foreign PEPs can be particularly difficult due to the vast number of countries and varying political structures.

Related Read: Why PEP Screening is Important for KYC and AML Compliance

How to Conduct Enhanced Due Diligence on PEPs

Enhanced due diligence (EDD) is a heightened level of scrutiny applied to customers who pose a higher risk of money laundering or terrorist financing to help mitigate the potential for PEPs to misuse the financial system for illicit activities. EDD measures is a mandatory process for PEPs to understand the nature and source of their wealth and funds.

Specific EDD measures for Politically Exposed Persons include

- Senior Management Approval: Requiring approval from senior management for establishing business relationships with PEPs.

- Source of Funds and Wealth (SOW): Conduct thorough inquiries to understand the origin of the customer's wealth and the source of funds for transactions.

- Beneficial Ownership: Identifying and verifying the ultimate beneficial owners of accounts and transactions.

- Ongoing Monitoring: Implementing enhanced transaction monitoring to detect unusual or suspicious activity.

- Politically Exposed Relatives and Close Associates: Extending due diligence to family members and close associates of the PEP.

- Documentation: Maintaining detailed records of all EDD procedures and findings.

Read our blog post on the Anatomy of High-Risk Politically Exposed Persons in Nigeria.

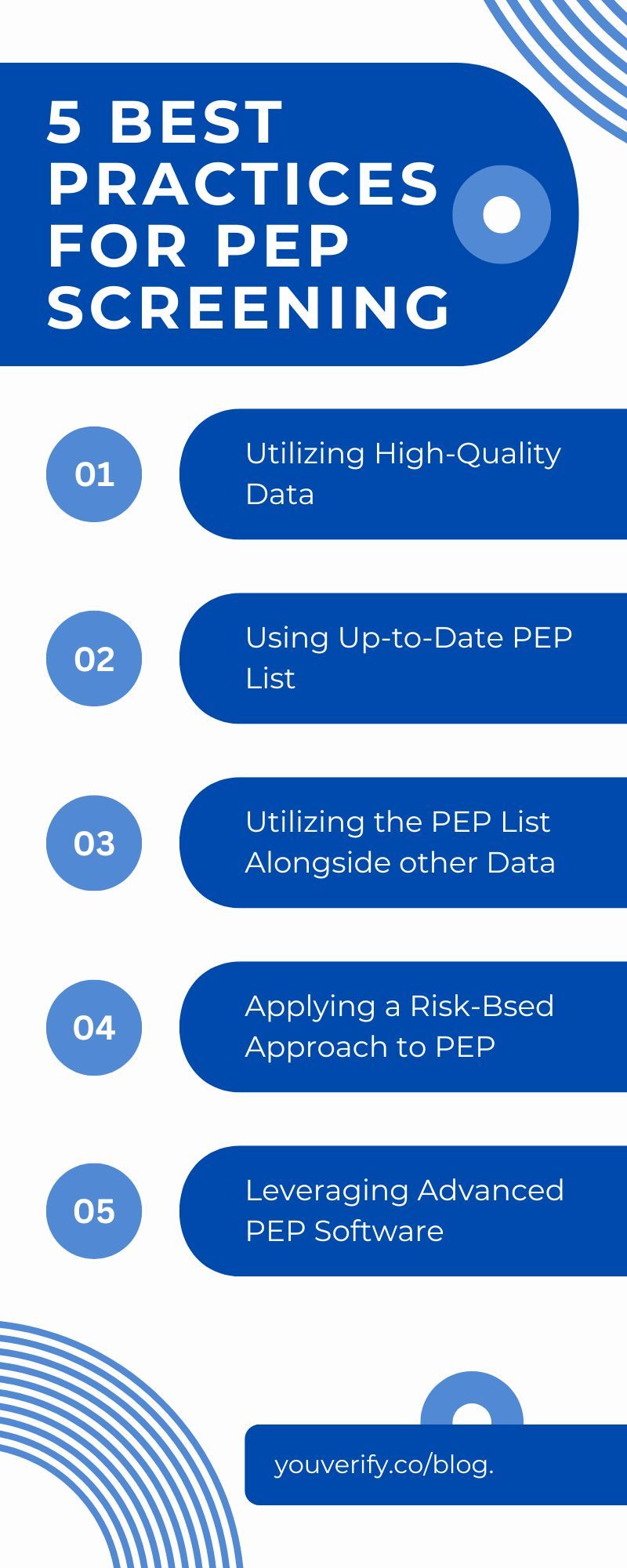

PEP Screening Best Practices

These 5 best practices for PEP screening will help financial institutions overcome the challenges of PEP screening:

1. Utilizing High-Quality Data

Using high-quality data for the PEP screening process is the first PEP screening best practice in getting an accurate PEP screening process done. The quality of data will determine the accuracy of the screening process. The use of high-quality resources such as the PEP list, FATF watchlist and public records of PEP and their close associates will directly impact the result of the screening process.

High-quality PEP data can be gotten from reputable regtech companies, government platforms, and reliable media sources

An accurate and high-quality database includes all jurisdictions. Domestic PEP lists usually have regulatory requirements different from foreign PEP lists. An example of a domestic PEP list can be explored in our blog.

2. Using Up-to-Date PEP List:

PEP screening requires ongoing monitoring throughout the PEP customer relationship with their bank. Hence, banks must ensure they stay up to date with the constantly changing politically exposed person list. This may be a daunting task, however, partnering with a trustworthy regulatory compliance company can ensure that banks stay compliant with AML/CFT regulations.

3. Apply a Risk-Based Approach to PEPs

A crucial aspect of EDD is assessing the level of risk associated with each PEP. This involves evaluating factors such as:

- The PEP's position and level of authority.

- The jurisdiction in which the PEP holds office.

- The nature of the business relationship.

- The complexity of the customer's financial activities.

- The PEP's reputation and any negative media coverage.

Foreign PEPs are generally classed as high-risk PEPs while domestic PEPs are considered low-risk. By carefully assessing these factors, financial institutions can tailor their EDD measures to the specific risk profile of each PEP.

4. Utilizing the PEP List Alongside Other Data

PEP screening should not be done with the PEP list alone. To get a comprehensive risk profile for PEPs, the list should be used in combination with other data sources such as:

- Adverse media screening for financial misconduct

- Government sanctions and watchlist databases

- Corporate registries and ultimate ownership information

- Transaction Monitoring and pattern analysis.

5. Leveraging Advanced PEP Software/ Tools for PEP Screening Automation

The large number of PEPs across the globe warrants the use of PEP software. These PEP screening solution uses automation, machine learning and artificial intelligence to improve financial institutions' risk management.

Youverify’s PEP screening software seamlessly integrates into a bank’s core system to automatically verify customers against comprehensive PEP lists and other related data sources. This screening process is initiated at key customer lifecycle stages, such as onboarding and periodic reviews, as well as when PEP databases are updated.

Potential matches are flagged for immediate attention by compliance teams. Advanced solutions further prioritize these alerts by assigning risk scores to PEP matches, enabling banks to allocate resources efficiently and focus on the most critical cases.

Technology can be used for the PEP screening process in the following area:

- PEP Databases: Comprehensive and up-to-date databases of PEPs are essential for accurate identification.

- Advanced Matching Algorithms: Sophisticated algorithms can compare customer data against PEP databases to identify potential matches.

- Watch List Screening: Tools that monitor for changes in PEP status and other relevant information.

- Due Diligence Platforms: Integrated platforms that streamline the entire PEP screening and due diligence process.

By leveraging these technologies, financial institutions can significantly improve the accuracy and speed of PEP screening, reducing the risk of overlooking high-risk individuals.

Read about the Importance of Real-Time Sanction Screening Solution

Identify High-Risk Customers with Youverify's PEP Screening and Sanction Solution

Identifying high-risk customers does not have to be a difficult task when you have the right partner. The challenges are too risky to give room for error. You can easily identify PEPs through Youverify's real-time PEP and sanction screening solutions, match customers with constantly updated global databases to protect your business and comply with AML regulatory requirements.

Join 100+ companies to stay compliant with AML regulations and requirements. Request a FREE DEMO to see how it works.