PEP screening is an important part of AML compliance and KYC for banks. PEP means Politically Exposed Persons are people who occupy a position in the government and are more liable to commit financial crimes such as laundering illicit money through banks and other economic systems.

PEP and sanction screening processes are important in banking to prevent money laundering, reduce corruption and protect the bank’s reputation. As important as these processes are for banks, they usually pose a challenge for banks trying to implement the AML process and meet PEP screening requirements.

This article will discuss the process involved in PEP screening in banking, the different PEP screening requirements and regulations in different countries and how banks can overcome the challenges of screening PEPs.

What is PEP Screening in Banking?

PEP screening in banking is the process financial institutions use in identifying and assessing individuals who hold significant political positions such as government officials, ministers, or members of parliament. These individuals are known as Politically Exposed Persons (PEPs).

Banks are under obligation to perform PEP and sanction screening on any potential customer to rule out any risk of them using their banks to launder proceeds from illegal activities.

PEP screening is also known as PEP checks.

What is PEP and Sanction Screening in Banking?

More often than not, PEP and sanction screening are usually used interchangeably and may be confusingly used together. However, these two are different. Let us clear them.

PEP screening in banking involves identifying individuals who hold or have held prominent public positions. These individuals are considered high-risk due to their increased opportunity for involvement in financial crimes like bribery, corruption or money laundering activities.

Sanction screening in banks involves identifying PEPS against sanction lists to ensure compliance with financial regulations and prevent banks from dealing with sanctioned individuals involved in illicit activities.

Read More: Politically Exposed Persons: Who Are They and Why Do They Matter?

What are the PEP Screening Processes for Banks?

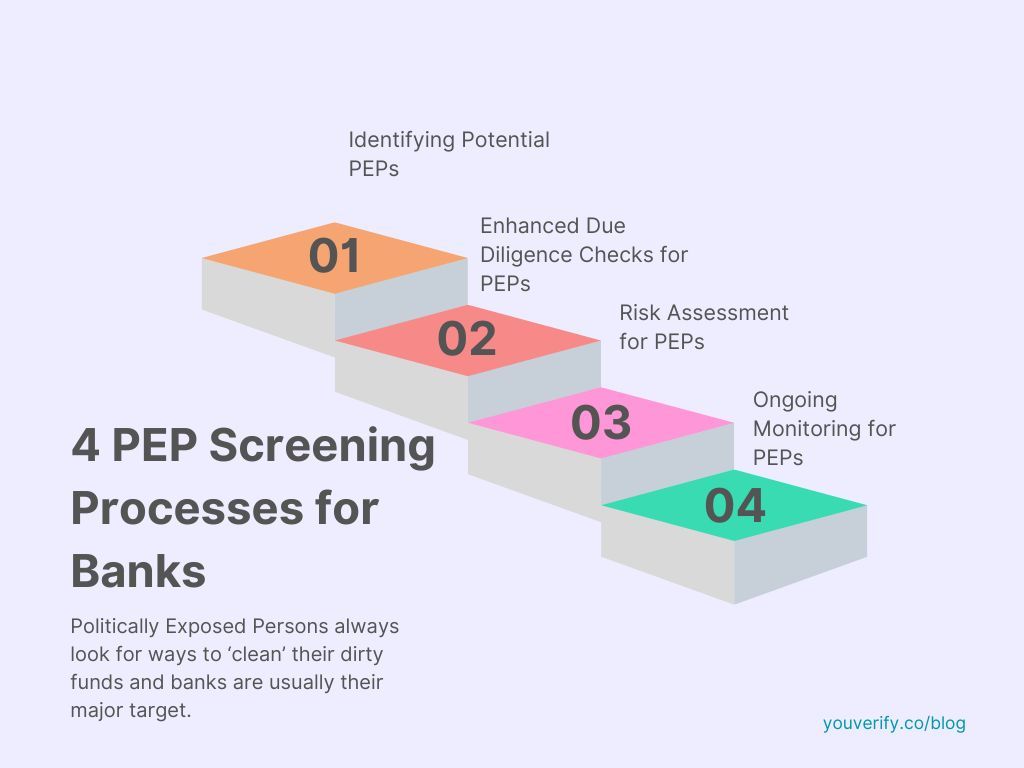

Politically Exposed Persons always look for ways to ‘clean’ their dirty funds and banks are usually their major target. What are the steps banks go through during the PEP screening process? Here are the major steps:

1. Identifying Potential PEPs

The first step in the PEP screening process for banks is the identification of PEPs. There are several ways banks can identify PEPs: Using databases, media monitoring and customer information.

A. Using Databases or PEP Checklist: Banks can leverage government databases such as PEP lists or databases maintained by international organizations like the Financial Action Task Force (FATF) or national governments (if it is a domestic PEP list).

The FATF guidance on politically exposed persons List can be downloaded for free here.

B. Media Monitoring: Banks can also identify PEP by monitoring news outlets, social media and other public sources for information about individuals who have assumed or held important political positions. This process is called Adverse media screening. Adverse media screening particularly allows banks PEP screening for AML.

More often than not, news stories involving politically exposed persons (PEP) may be an indication of financial crime or corruption before it is confirmed through official means. With the right real-time adverse media screening tool, institutions can easily identify changes in a customer risk profile, creating real-time solutions to address the threats in time.

C. Customer Information: During onboarding or account updates, banks may also collect information about customers' occupations, affiliations, and public roles that could indicate potential PEP status as part of PEP in KYC.

2. Enhanced Due Diligence Checks for PEPs:

Once a potential PEP is identified, banks are required to conduct enhanced due diligence checks. This involves gathering additional information to verify the individual's identity, source of wealth, and the nature of their political position.

A. Source of Funds: Banks may require PEPs to provide documentation explaining the source of their funds. This can include bank statements, tax returns, or other financial records.

B. Beneficial Ownership: Banks may also need to identify the beneficial owner of a corporate entity where a PEP is a significant shareholder or director. Banks can identify beneficial owners for aml/kyc and kyb compliance.

3. Risk Assessment for Politically Exposed Persons:

The next step for PEP screening in banking after conducting enhanced due diligence is to assess the risk associated with the potential PEP.

Based on risk assessment, PEPs can be categorized into low-risk PEPs, medium-risk PEPs, and high-risk PEPs. This categorization in turn determines the level of due diligence, monitoring and risk mitigation measures that will be employed during PEP screening for AML compliance.

- Low-risk PEPs require the basic standard due diligence process and periodic monitoring.

- Medium-risk PEPs require enhanced due diligence and frequent monitoring, and probably a senior management approval in the bank before onboarding.

- High-risk PEPs required stringent measures such as in-depth source of wealth verification, daily or ongoing monitoring and ongoing enhanced due diligence. They will also need to be checked against the sanction screening list.

The key factors used in determining PEP risk assessment include:

A. Nature and Influence of the PEP’s political position:

The higher the position and influence, the greater the risk posed by the PEP. This means a head of state poses a higher risk than a local government chairman.

B. Country Risk:

Certain countries have been grey-listed or blacklisted by FATF. This is based on the level of corruption and political instability in the country. A PEP from a grey-listed country will be subject to higher scrutiny and enhanced due diligence.

C. Adverse Media Checks:

Any PEP who has made it to the news, especially for negative news such as flaunting of wealth, corruption or bribery allegations, in the past are more likely to go through higher scrutiny by banks.

C. Length of Time Since PEP Left Office:

The longer a PEP has been out of office, the lower the risk they pose as their ability to abuse power and engage in financial crime diminishes over time. A serving PEP on the other hand poses higher risk and therefore should be subject to higher scrutiny by banks.

4. Ongoing monitoring for PEPs

The last step for the PEP screening process in banking is the ongoing monitoring stage. Banks must periodically monitor and review PEP to ensure that the initial risk assessment remains accurate and that there are no changes in circumstances that could increase the risk.

This stage also includes suspicious activity reporting. Here, banks are required to report any suspicious transactions including transactions that appear inconsistent with the PEP’s known financial profile or that may indicate corruption or money laundering.

To achieve accurate ongoing transaction monitoring for PEPs, banks must stay updated on the ever-changing PEP lists and databases both nationally and internationally to identify new PEPs or changes in the status of the existing ones.

PEP screening in banking is important, however, the process can be challenging due to reasons such as global non-uniformity in PEP definition, constant change in the political status of PEPs, and name variation leading to difficulty in identifying PEPs. However, following these best practices for PEP screening for banks will help banks overcome these challenges.

What are the PEP Screening Regulations and Requirements for Banks?

PEP screening regulations are important for banks and other financial institutions as they help them identify and manage risks associated with Politically Exposed Persons (PEPs).

There are different PEP screening regulations and requirements across different countries. Let us explore some of them.

1. The United States

Regulatory Framework: PEP and sanction screening in the United States is governed by the USA Patriot Act and the Bank Secrecy Act. Under these acts, financial institutions are required to conduct PEP screening as part of their risk-based AML/CFT programs.

Requirements: Firms especially banks must screen for foreign PEPs but are not mandated to screen domestic PEPs. Enhanced Due Diligence (EDD) is required for higher-risk PEPs, and suspicious activity must be reported to the Financial Crimes Enforcement Network (FinCEN) if a PEP is suspected of money laundering activities.

2. United Kingdom

Regulatory Framework: The Financial Conduct Authority (FCA) governs PEP screening regulations in the UK. They mandate comprehensive PEP screening for both foreign and domestic PEPs.

Requirements: Financial institutions must implement effective PEP screening as part of their broader AML/CFT compliance measures. This includes identifying and monitoring PEPs to mitigate financial crime risks.

3. European Union

Regulatory Framework: The EU requires PEP screening as part of the AML/CFT directives, emphasizing a risk-based approach.

Requirements: Financial institutions must screen customers during the onboarding process and continuously monitor for changes in PEP status. Enhanced due diligence is triggered for customers identified as PEPs or from high-risk countries.

4. United Arab Emirates (UAE)

Regulatory Framework: The UAE mandates PEP identification as part of the Customer Due Diligence (CDD) process under its AML/CFT regulations.

Requirements: Financial institutions must classify customers as PEPs or high-risk individuals and conduct ongoing monitoring and screening during the business relationship.

5. Canada

Regulatory Framework: The Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) establish requirements for PEP screening in Canada.

Requirements: Canadian firms must screen both domestic and foreign PEPs, with continuous monitoring and EDD for high-risk individuals.

6. Other Regions

India: PEP screening is required for foreign PEPs, with ongoing efforts to strengthen compliance as it works towards full FATF membership.

Latin America: Countries in this region follow FATF guidelines, requiring PEP screening as part of AML/CFT measures.

PEP Screening for Banks with Youverify’s Free PEP Screening List

PEP screening in banking is an important part of AML compliance and they cut across several countries. Failing to comply with these regulations usually leads to hefty penalties and reputational risks for these banks.

However, screening PEPs does not have to be a difficult task. There are automated PEP screening tools that can help banks identify high-risk PEPs easily and accurately to comply with necessary regulatory requirements. With Youverify's robust and comprehensive PEP List Check, banks and other financial institutions can now screen potential customers against an updated database.

Youverify's PEP screening tool empowers banks to take a risk-based approach to PEP screening enabling them to identify and mitigate risk while meeting regulatory requirements. Book a FREE DEMO with our compliance experts today to try this product.